You might like reading:

Economic Analysis of Germany

From the past couple of years there has been increased fear and restlessness among the investors regarding the euro crisis which is basically rose out of the rising government debts in some of the European states. This has caused widespread distress and affected economies all round the world, with rescue packages worth hundreds of billions of Euros also not sufficing […]

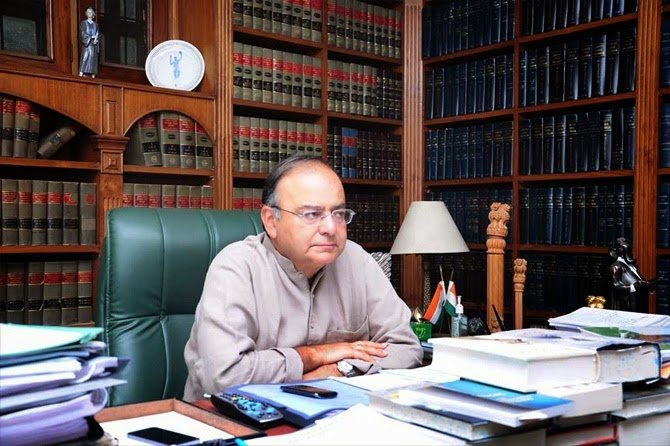

The Indian Union Budget 2014-15: What can we expect?

The newly elected Indian government will have their task cut out as they are set to present their first financial budget in the month of July for 2014-15. The economy is facing structural issues with GDP growth hovering around the 5% mark over the last 2 years.So can the new Finance Minister Mr. Arun Jaitley deliver? There are a […]

Thanks for insightful article! Most of the B school students take government bond rate as risk free rate while doing valuation of company. As you discussed about credit spread, where should one find it? As it depend on economic ,social, political factors, it will keep changing accordingly. So,how one should keep track of credit spread?