Most of us, after getting up in the morning, have been consciously or unconsciously reaching out for a tooth brush and a tube of toothpaste for many years now. Brushing is so much a part of our daily set of activities that it can now be considered a habit. It’s this habit that gives rise to the global oral care market presently estimated at US$12.6 billion. Currently nearly 97% of the population in developed countries uses at least one variety of toothpaste and 87% of this population, brushes twice daily. This gives marketers virtually no space to expand the market with new users in this region. In stark contrast, only 55% of the Indian population uses toothpaste and less than 15 percent of the Indian toothpaste users brush twice a day, only indicating that the market here remains largely untapped.Dental Caries or tooth decay is the primary problem as far as oral problems are concerned. Dental Caries are caused by bacterial processes on sugar or carbohydrates, in food left in the mouth after eating. As per data provided by FDI World Dental Federation, the dental caries reported per capita in India is about twice of that reported in Scandinavian countries, whereas the annual consumption of sugar by a person in India is half of that of someone in Sweden. This can be attributed to the fact that the per capita consumption of oral care products like toothpaste in India is a meagre 127 grams as compared to Europe, where it is over 300 grams. Surprisingly even the Chinese and Malaysian citizens consume much more toothpaste than their Indian counterparts, with their consumption levels estimated at 255 and 304 grams annually. In rural areas of India, the penetration of oral care products is just one third of that in urban areas. Here people predominantly clean their teeth with natural items like twigs of neem tree, salt and ash. With steady growth of Indian Economy, the per capita income of India has increased from Rs 18,885 in 2002-03 to Rs 54,527 in FY’11, hence purchasing power of the Indian consumers is constantly increasing. After factoring in all these points, one can’t help but conclude that a tremendous opportunity lies in the oral care market of India.

THE MARKET AND ITS PLAYERS

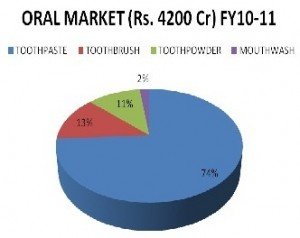

Oral care in India has been greatly driven by innovation, retail availability, packaging and promotion. The Indian oral care market is presently estimated at Rs. 4200 crores, of which toothpaste contributes the largest chunk, accounting for approximately 75% of the total market. The toothpaste market is estimated at Rs 3100 crores and is expected to reach Rs 3,226 crores by 2012. The toothpowder market, valued at Rs 472 crores, on the other hand, is expected to drop to Rs 458 crores by 2012. The mouthwash market – an infant product segment for now — is valued at Rs 84 crores and is expected to reach Rs 90 crores by 2012.The toothbrush market is valued at Rs 550 crores.

The Indian oral care market has traditionally been a strong hold of three FMCG majors, namely Colgate-Palmolive, Hindustan Unilever Limited and Dabur, as the “big three” have jointly held more than 85% of the market share, both by volume and value, in the past decade.

MARKETING STRATEGIESColgate-Palmolive India Limited

Colgate has been a household name and has virtually been synonymous with dental grooming for generations of Indians. The company’s wide oral care portfolio offers a plethora of products ranging from toothpastes, toothpowders and mouthwashes under the Colgate brand and a specialised range of dental therapies under the banner of Colgate Oral Pharmaceuticals. For the urban households the company has positioned gels, tooth whitening toothpastes, mouthwashes and its herbal brands under a premium price range, while long standing products such as Colgate dental cream, Cibaca and Colgate toothpowder are targeted at rural and the urban lower income consumers.

Recent Product/Marketing strategies:

1. Colgate-Palmolive launched Colgate Total 12 to compete with Pepsodent as Pepsodent made claims of offering protection from germs “through the night”. Thus Colgate introduced a tooth paste that could supposedly fight germs for 12 hours.

2. Colgate introduced its brand Colgate Activ Salt in the market with a unique selling point of having a dash of “salt” in the toothpaste.

Hindustan Unilever Limited

HUL had launched Pepsodent in 1993 in an attempt to challenge Colgate. Hindustan Unilever, the country’s largest personal care company, had first come out with Close Up to take on Colgate. But the move failed as Close Up was positioned as a mouth freshener. With Close Up on a weak wicket, the company needed a brand like Pepsodent which targeted children. Hindustan Unilever positioned Pepsodent as a toothpaste that offered long-lasting protection from germs; it could fight germs for hours after brushing. But eating into Colgate’s pie was no menial task. By 2000, Pepsodent had tried every trick in the book. So much so, that Hindustan Unilever aggressively marketed it in the rural market at Rs 10 for a 40-gram pack, though it was originally positioned as a premium brand. Research suggested that mothers worry about what their kids eat, especially when they are away from them, and its impact on their dental health. Using that insight, Pepsodent launched the ‘Dishoom Dishoom’ ad that said: Let Pepsodent fight germs for you. Finally, Hindustan Unilever had hit bull’s eye. Pepsodent’s market share went up from 10.96 per cent to 13.81 per cent in a matter of eight months. Close Up, on the other hand, was positioned as a youth oral care brand from the very beginning. Clearly, HUL derived critical mass growth from having two brands targeting two different sections of consumers – Pepsodent as a family brand and Close Up as a youth product.

Dabur India Ltd.

Dabur occupies around 9.5 percent of the total oral care market in value terms and 12.5 percent in volume terms. In white toothpaste it offers the Promise brand. Under herbal oral care, it offers Dabur Red, Dabur Red Gel, Babool, Babool Neem and Meswak in toothpaste,and Babool and Dabur Lal Dantmanjan in toothpowder. Babool is targeted at the economy segment, Dabur Red focuses on the popular category and Meswak is positioned in the premium segment. With an overall turnover of Rs 100 crores, Babool is currently the biggest brand in the Dabur oral care portfolio.

Glaxosmithkline

In Jan 2011, GlaxoSmithKline Consumer Healthcare India (GSK) launched its global oral care brand Sensodyne in the Indian market. GSK planned to invest close to Rs 25 crore for the launch phase of Sensodyne. This includes marketing initiatives like mass advertising and reaching out to 15,000 dentists to take Colgate-Palmolive head-on. Also, GSK resorted to Experiential Marketing – marketing which allows customers to engage and interact with brands, products, and services in sensory ways and take more informed decisions – through initiatives like “chill tests”. Through this, GSK plans to acquire 5% share in overall toothpaste in next 3-5 years.

Future Group

The Sach brand of toothpastes was co-created by cricket giant Sachin Tendulkar and Future group, aiming to achieve at least 25 per cent of its in-store toothpaste sales from retail platforms like Big Bazaar and Food Bazaar. The Group is believed to have sold over 25,000 items of the product within three days of the launch.

Vicco Group of Companies

One of the pioneers of herbal oral care products, Vicco’s brands include Vicco Vajradanti Paste, Vicco Vajradanti Sugar Free paste and Vicco Vajradanti powder. Vicco has stuck to its age old advertisement and jingle which is easily recognizable. These ads are now screened in multiplexes instead of prime time television.

Perfetti Van Melle India (Happydent White)

Happydent White is a coated functional gum available in Peppermint and Fruit flavours with special ayurvedic recipe. The brand’s positioning is that ‘chewing happydent White can give you a sparkling smile’. Happydent White offers two sugar free variants — Protex Happydent and Happydent White Xylit. Perfetti Van Melle’s very popular ‘Happydent White Palace’ advertisement is a case in point. Conceptualised by Prasoon Joshi and McCann Erickson, the ad communicates dental hygiene as a fun activity by making it interesting rather than therapeutic.

Wrigley India Private Ltd. (Orbit)

Wrigley’s Orbit sugar free chewing gum is endorsed with the benefits of providing oral health, teeth whitening and curing gum diseases. It has also been awarded the Indian Dental association (IDA) seal of acceptance as an oral care product.

Johnson & Johnson Ltd. (Listerine)

The company markets two variants in mouthwash, Listerine and Coolmint Listerine. Listerine India as of September, 2010 held a 70% share in the OTC (Over the Counter) mouthwash market

Elder Health Care Ltd. (AMPM)

The mouthwash brand was launched in 2002. The variants are AMPM Plus, for regular use and AMPM Special, for smokers and tobacco chewers.

The Changing Dynamics of Indian Oral Care Market

The dynamics of Indian Oral care market are now changing at a rate never witnessed before. With the market volume increasing at over 8% percent per annum, many regional as well as global brands see Indian market as a lucrative option for their products: New players like Glaxosmithkline, Himalaya Drug Company, Future Group and Henkel India trying to offset the “big three” in traditional toothpaste segment. Latest entrant being Sensodyne by GSK which was launched in January 2011, and has already garnered a 10% share of Rs 209 crore sensitive toothpaste market. Also P&G is planning to launch CREST, its no.1 selling toothpaste in USA. Companies like Johnson and Johnson, Elder Phrama, Wrigley India and Perfetti Van Melle are taking the market by storm by introducing products in niche segments like mouthwash, tobacco chewers, teeth whitening and gum curing chewing gums. The “big three” are now eating each other’s share of pie by introducing products in which their competitors had expertise.

Challenges and SolutionsFor Rural Market

As far as the untapped rural market is concerned, majority of people in rural area are not aware of oral hygiene and its importance. People extensively use twigs of neem, salt, ash and other herbal products only. Hence it becomes imperative for companies to first reach and educate the potential consumers about vitality of oral hygiene and how their products can ensure that. To build a strong rural distribution network, local distributers who know the community, villages, understand public sentiments need to be involved and given some extra perks to make efforts to create a market where it does not exist. As a part of brand promotion, road-shows, street theatres, sports events for youths, and oral health care camps in schools can be organised or sponsored where locals can be educated about Oral care and their products.The brands need to rethink about the products for rural consumer and come out with cheaper options, for example by spending less on packaging, by selling smaller quantity i.e. sachets in larger numbers. Retailers and medical practitioners can be talked to, and given compensation for pushing and a particular product as their opinion might influence consumer choice.

For Urban Market

For a market that is already loyal to its brands, innovation and value addition are required to win new customers. Also “brushing twice a day” as a habit, needs to be endorsed for increasing the consumption of toothpaste. Consumers can’t resist the word FREE. So many a times, marketers give something FREE with a product to increase or push its sales. Oral care brands could hand out a free oral care health booklet with certain products, which could be used for spreading awareness about various oral problems and how products in their offering could help cure/prevent these problems.Oral products specifically targeting special needs like for gum problems, bad breath, or segmenting customers into specific age bands might also find many takers.Coupling oral care products like toothpaste and mouth wash, that complement each other well, can also be sold as a “combo” pack to push sales. Smart endorsements targeting the young urban consumer should be devised as it’s no longer possible to mislead urban consumers with tall claims.

[The article has been written by Anurag Choudhary and Satvinder Singh. They have completed their MBA from NMIMS, Mumbai]

Tags: dental happydent oral careYou might like reading:

A peek into the CEO’s life at Edupsyche

We present to you the interview with the Dr. Bhavi Mody, CEO, Edupsyche. Edupsyche is a Mental Health care initiative, a vertical of Vrudhi Research Foundation which intends creating platforms and service deliveries for Mental Health industry across the country. Q1. Firstly, a very warm welcome from Ideasmakemarket.com team. “Edupysche” is one-of-its-kind venture in the mental health care industry. Tell […]

The Social Animal : How social media is impacting our lives

We have always come across the statement “human is a social animal ”.However, according to me, it has NOW stepped up to the new fancy of digital life making them social media animals. Social media has, lots of positives whether it is showcasing your talent or digitally marketing the products, connecting with friends you lost touch with or helping people […]