With the Season of investments going on and so many tax saving options in the 1 lakh limit available under Section 80C, 80CCC and Section 80CCD, it is not very difficult to figure out which one is the best suited and hence is the best investment option (in terms of ROI). However, the option above 1 lakh limit is limited.

Long term Infrastructure bonds belonging to above 1 lakh limit are debt instruments in which the limit is up to Rs 20,000 for tax benefits under the section 80CCF. These bonds have a minimum tenure of 10 years with a 5-year lock-in period and interest rate (cumulative or annual) varies across different bonds from 7.5-9.5%.

Are these bonds really worth an investment? First of all investment in this category should come only after the 1 lakh limit category is completely exhausted and investor is looking for a long term investment given its rate of returns compared to the other available options.

Secondly, tax saving through these bonds should be a secondary criteria as they carry with them a big tenure (or lock-in) which makes them less appealing. Let us say an Investor in 10 percent tax category; he/she may take a call on whether it is worth saving a tax of Rs 2,000 by locking in Rs 20,000 for 5-10 years considering other better options available in the market in the form of Mutual funds, Gold ETFs etc.

Thirdly, although investors have an option to sell these bonds in secondary market when these bonds get listed in stock exchange but their liquidity in the market is relatively low and most of the time traders are least interested in buying them. Even if investors do a put option and any other company is interested in offering higher interest rate, one has to hold the bonds till maturity. On the better side if somebody wants to get rid of them, investors can do a put option after 5years (lock-in) and issuer will buy back bonds from them at par.

Experts recommend Infra bonds but it should be on one’s own discretion (considering the market and the economy) if the benefits one wants to reap will be best served only by buying Infra bonds. In terms of ROI there are better options available in the market as mentioned. All in all it should be a calculated investment as one is locking the money for at least next 5 years with pre-defined rate of returns, which cannot be changed even if the other options are sailing more than twice the return rate in these 5 years.

[The article has been written by Sandeep Tharwani. He did his B Tech from NIT Calicut in 2009 and is presently working as consultant in Deloitte Consulting, Hyderabad. He loves to explore the area of marketing and brand management as much as he likes equity trading (analysis) and studying market trends. ]

You might like reading:

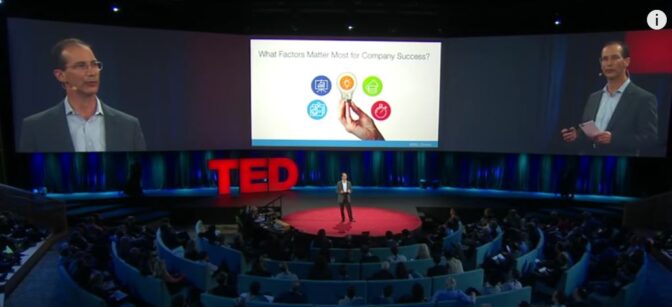

Video : Why Startups Succeed

What is the most important part of building a successful startup? While many people reckon it as the idea behind it, the reality is that perhaps the secret ingredient is actually “Timing”. This TED talk by Bill Gross explains the key ingredients in making a venture successful. Do you agree with his views ? Tags: Bill Gross startup TED

The Way Singaporeans Live!!

In 1959 Singapore attained its full government and election was won by People Action Party whose leader Lee Kuan Yew became the first Prime Minister of Singapore. Lee Kuan Yew was the world’s first country Marketing Director who built “Singapore”as a brand. According to United Nations Human Development Index (UNHD) 2014, ranks Singapore as 9 out of 187 countries with feeling of belonging, vibrant […]