Prelude :

“… reserve currencies come and go. They don’t last forever. International currencies in the past have included the Chinese Liang and Greek drachma, coined in the fifth century B.C., the silver punch- marked coins of fourth century India, the Roman denari, the Byzantine solidus and Islamic dinar of the middle-ages, the Venetian ducato of the Renaissance, the seventeenth century Dutch guilder and of course, more recently, sterling and the dollar.” – Avinash Persaud (2004).

Fall of Greenback :

Prior to US dollar taking the role of world’s reserve currency, British pound was holding that status. Pound lost its status when Britain became a net debtor as well as a net borrower after World War II. And today, US dollar has almost similar status that British pound had at that time. The growth of US government’s debt has become alarmingly high for last few years. The ratio of US public debt-to-GDP was an abysmal 110% in 2011. With over $14 trillion debt, US economy has lost its AAA credit rating. Standard & Poor downgraded its rating to AA+, and keeping their consistent fall in economic status in mind, it might be cut to just AA within a couple of years. Looking at the facts, figures and possibilities, US may hit a slowdown or even a double-dip recession in future, as their account deficit and fiscal deficit are not under control. Not only they are running massive budget and trade deficits, they have become dependent on the foreign creditors who themselves are unfathomable about accruing more dollar assets. Two main reasons behind US dollar’s becoming the world’s reserve currency after World War II were: (1) US had world’s largest manufacturing base, (2) It was backed by gold. Today China has taken over the glory of having the largest global manufacturing base and US dollar is no longer backed by gold too. All these series of crises have shaken the position of dollar in the global picture and have arisen the most critical question – which currency has the capability of owning the reserve currency status replacing dollar? Euro, Japanese Yen, International Monetary Fund’s SDR (Special Drawing Right), Chinese Yuan (Renminbi) – a plethora of options are available with their respective set of justification and flaws.

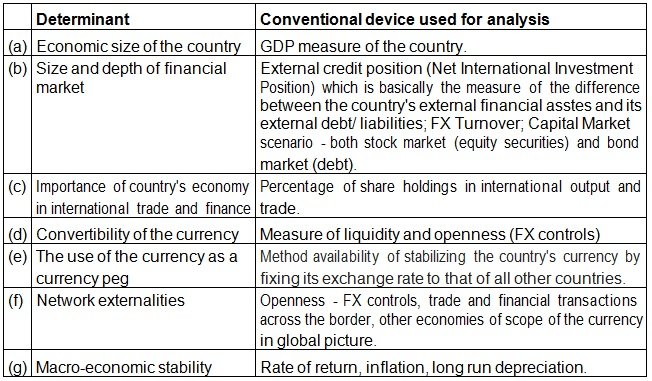

Key determinants for choosing a suitable reserve currency :

However, judging by the key criteria those were mentioned previously for holding the position of an appropriate reserve currency, renminbi falls short primarily in two aspects: full convertibility and network externalities. China’s financial market is not fully grown. Their equity market capitalization is 5.9% of world’s entire equity market as share and bond market capitalization is 2.4% of world’s entire bond market as share respectively. China has had very limited offshore trading too.

Despite the drawbacks, they have the potentiality to bring in the change and they are working hard to remove the shortcomings. Their authorities have begun allowing offshore financial transactions by foreign investors in renminbi. People’s Bank of China has started allowing foreign banks and multilaterals to invest a part of their offshore renminbi funds in China’s onshore domestic interbank bond market. In the long run, this will attract exporters from other countries to accept payment in renminbi.

It is clearly visible from the effort and initiatives of China that they are trying hard to internationalize renminbi, but entire internationalization denotes capital account convertibility. And pragmatical prediction says that it is not possible overnight. Definitely China’s economic prowess, both current and projected, are appreciable and renminbi has the potentiality to supplant US dollar (though recently occurred drastic fluctuations of euro again warns about uncertainty), but not now, may be it would take five or more years down the line. The increasing private use of renminbi in Asia for consumption in border trade payments is mainly a reflection of the importance of the Chinese economy in Asia. The limitation in usage of renminbi comes mainly from current capital controls on China’s capital account transactions. Their short-term capital flows are controlled. Without full convertibility, renminbi would not be considered for a vast range of purposes. Summing up the things, if, liberalization of capital account, providing greater flexibility of the renminbi exchange rate, growing bond and equity market, slight adjustment to existing legal system (though there is no restriction on renminbi’s convertibility under current account, there are several restrictions on its convertibility under capital account) – all these can be done greadually, renminbi can move steps ahead in terms of internationalization.

Special Drawing Rights

It was first issued by International Monetary Fund and the nominal value of SDR is derived from a basket of currencies – fixed proportion of US dollar (41.9%), euro (37.4%), british pound (11.3%), japanese yen (9.4%). SDR was supposed to act as the primary asset held in FX reserves during Bretton Woods era, but after british pound’s demise, it took a backseat and kept itself aloof from any important role. SDR has the capability of acting as a wide reserve-pooling arrangement that can be useful in balancing global liquidity from countries with ample liquidity to the countries with higher need of it.

One problem with SDR is it is a kind of synthetic currency, it is not a hard currency that can be brought and sold in private markets. Moreover, current composition of SDR is of no help since it has greater percentage of dollar and euro only. Albeit, the official SDR basket weights and components are subject to re-evaluation and re-adjustment by IMF after a period of every five years.

Viable Solution :

Almost identical to SDR, a mixed/hybrid/flexible pool of reserve currencies (with Chinese Renminbi as its primary component) will be the best candidate to hold the position of new and composite reserve currency. Currencies of other BRIC countries viz. Brazil, Russia, India can also be a part of forming the new hybrid currency since they have already decided to dump dollar and moving into a global currency scheme. And as of now, China has already met the export target of the SDR basket. Once the central banks of China allows to hold renminbi-denominated deposits without restriction, and it becomes convertible on capital account, renminbi can easily be a key component of SDR. In fact, broadening the currency base of the SDR basket is on the agenda for G20 leaders at their Canner summit in Nov’2011. The G20 decision to create $250 billion in new SDRs marks a major step towards establishing the SDR as reserve cuurrency. Today, US dollar and Euro jointly hold 80% share in SDR composition. If renminbi is given a considerable amount of share (at least 25%) after resolving the issues with its full convertibility in capital market, it can proved to be an efficient way to alleviate the dismal effect of recent financial crisis.

However, many economists claim that selecting a multiple currency basket as the reserve currency is a virtual concept, and in reality, importers, exporters, bond underwriters generally want to use only single currency. This is a back-dated notion. Currency conversion is now an in-built application in every common man’s mobile phone set. This apart, the mammoth size of today’s global economy clearly indicates that there is no room for deep and liquid markets in one single currency. So, considering all the pros and cons, the final verdict is making renminbi convertible in capital market first, and then altering the composition of SDR by providing renminbi at least 25% share, and finally making SDR (or a composite currency with some other name) the new reserve currency supplanting US dollar as the sole reserve currency.

Bibliography

1.“The Future of Reserve Currencies” – Benjamin Cohen

2.“International Currency Competition: Are There Alternatives to the US Dollar?” – Sasidharan Gopalan

3.“The Future of the US Dollar as a Reserve Currency” – John Greenwood

4.“Sterling’s Past, Dollar’s Future: Historical Perspectives on Reserve Currency Competition” – Barry Eichengreen

5.“Whither the Renminbi” – Lawrence Lau

6.“The SDR as an International Reserve Asset: What Future?” – Maurice Obstfeld

[The article has been written by Chandrima Das. She did her B.Tech in Computer Science and is presently working as Administrative Officer (IT) in National Insurance Company Limited. Her dissertation on “Evolving customer centric strategies in General Insurance” got nominated under technical category essays of Insurance Institute of India.]

You might like reading:

SEO vs PPC Demystified : Understanding Digital Marketing

Importance of a well-thought-out digital marketing strategy cannot be overstated. Brands are fighting to get a share of the virtual market. The advent of digital marketing has dramatically changed how businesses function today. A quarter-century ago, the media was dominated by newspapers, television, and radio advertising. However, fast forward to today, brands are figuring out strategies – SEO vs PPC, […]

The 70 crore re-branding : The Frooti Life Campaign

Parle recently launched the all new Frooti – It’s iconic brand in an all new avatar. For this purpose, Parle had hired Sagmeister & Weish to design its new campaign for targeting the youths. The reality, though, is it really worth it? Frooti is more like a legacy brand in the same league as Maggi. In fact the name Frooti […]