There has been a great deal of talk all around the world ever since India was clubbed together as part of BRIC by Jim O Neil of Goldman Sachs. It was almost like a dream come true for 1 billion people (and counting!) and their aspirations to be recognised as one of the emerging market economies of the world. Did India deserve to be clubbed with China- the economic powerhouse of the new world order? The economic downturn and its impact on India’s GDP have proved otherwise.

Both India and China have reported slowing growth patterns over the same period. In fact, according to various analysts worldwide, India’s GDP might have grown anywhere between 4.9% to 6% in Q1 2012-13. On the other hand, China’s GDP according to China Daily grew by 7.8% in the first half of this year. These figures are no way indicative of India’s performance vis-à-vis China considering India’s target GDP growth has always been in the range of 8-8.5% whereas China has grown at double-digit rate for almost a decade. So if we analyse the scenario, both the countries have lost a significant portion of the momentum of their economies.

Result for economic growth: Tie (with edge to China)

If we look at the political scenario, both the countries appear to be in a phase of uncertainty. China has been facing dissidents in Uighur and Tibetan Autonomous region for quite some time, coupled with protests over wage rates and locals protesting over continued mining in the province of Inner Mongolia. Furthermore, it is due for its once-in-a-decade leadership change this December with Xi Jinping taking over the reins from Hu Jintao and the exit of Bo Xilai from Communist Party has further complicated matters. India seems to have exactly similar scenario: unrest in state of J&K and the north east coupled with spreading of Naxalite movement in various parts of the country has not helped matters much. The political leadership also looks unstable amid growing corruption charges, rise of the “Gandhian” Anna Hazare and Prime Minister Dr. Manmohan Singh, the architect of India’s economic growth, appears to be a shadow of his former self.

Result for political scenario: Tie

India remains a far younger country and can even emerge as the workforce supplier to the rest of the world in the next two decades. However, poor infrastructure and lack of education facilities for majority of population mean a lot remains to be seen how things span out in future and whether human resource emerges as India’s liability or asset. China, on the other hand, owing to its one-child policy has resulted in an aging demography. While there are talks about China abandoning its one-child policy from 2015 onwards, it will be interesting to see how the demographic advantage is going to play out in future.

Result for demography: Advantage India

In terms of military, China is leagues ahead in technology and in-house development. Both the countries boast of two of the largest armies, however while the Indian defence industry is primary dependent on imports with over 35 billion dollars in worth annually, its Chinese counterparty is otherwise. Both the countries have increasingly looked at increasing their nuclear missile artillery, however going by present strength China can defeat India through its conventional weapons.

Result for military: Advantage China

So what really sets the dragon one step higher than the Indian tiger? Perhaps it is the type of institutions that China has off-late been creating. Take for instance, the case of Lenovo: its rise has been meteoric both in domestic and international markets and in fact it is one of the preferred consumer brands in India as well. On the other hand, consider companies that India has produced in this domain- IT giants like TCS and Infosys. However, unlike moving up the value chain, these companies have been happy to serve as mere outsourcing destinations.

If we look at comparing the currency of the two countries: Yuan versus Indian Rupee- the Yuan is far ahead. It is currently pegged at 6.349 per dollar; the Indian rupee has depreciated to INR 55.63 versus the dollar. While one may argue, that the Yuan is a fixed currency, there is little doubt that it is well on its way to replacing the USD as the reserve currency in the coming two decades. Furthermore, with reserves of 3 Trillion USD, China can dictate the terms of trade with most countries in the world. India does not have a similar advantage. In fact with Indo-China trade expected to touch 100 billion USD by 2015, trade balance being in favour of China, the Yuan may emerge as a relevant currency in the Indian context as well.

Interestingly though, the two countries appear to have a formed a joint agenda when it comes to energy needs. The Joint Venture between ONGC and CNPC is a clear pointer in this direction in spite of tension existing between the two countries over exploration in South China Sea.

So can India ever really emulate (or even surpass) China? If we consider the above arguments, it seems unlikely. However, I hold a different view. These are some of the steps that I would suggest:

1. China has a reserve a 3 trillion USD, India does not have such a luxury. It is about time India should welcome FDI in most of the sectors with open arms. India has consistently adopted a pro FII approach; the approach should be changed and inclined more towards FDI. This is of urgent need.Allow 51% FDI in multi-brand retail while increasing the minimum sourcing from local SMEs to 50% of total commodities being sold in these outlets. Furthermore specify a minimum selling price (Germany follows a similar approach) so that predatory pricing tactics cannot be adopted. This will help in protecting the local livelihood while creating many more.

2. Engage in bilateral trade in rupee terms. This will help in rupee gaining strength.

3. Support and enhance the textile and apparel sector. India has an advantage in terms of quality in this sector and apparel manufacturers should be given tax breaks to compete with countries like Bangladesh. Furthermore, this sector has high employment generation possibility.

4. Create Infrastructure- this holds the key

5. Open up other sectors like Insurance to foreign players. India needs investments- if communist China can welcome it, should democratic India be far away?

6. It is not enough to make “Right to Education” a fundamental right- ensure that it is implemented as well.

7. India should increase import duties on Gold and at the same point develop its shale reserves in Arunachal and Thorium reserves in Kerala. Furthermore, Diesel subsidy should only be limited to rural India.

The list can go on actually. In fact, Mukesh Ambani had once said “India is a land of billion opportunities”- I firmly believe that it holds true. Indian companies like RIL have created benchmarks the world over. Furthermore, as Indian companies look at acquiring companies overseas, foreign companies should also be welcomed to acquire in India.

India presents a far more stable open economy than China. I also believe that in the coming years, strategic relations with China will play far more important role than Indo-US relations. Hence it is in India’s interests to forge closer ties with China and neither should it hesitate to accept China as the senior partner. A lot remains to be seen though how the two Asian giants fare together in future.

Mumbai can one day become Shanghai- the point is can we aim for New York?

You might like reading:

Consilium Vol I HRidhaan, IIM Raipur

Dear Readers, We at HRidhaan, believe that HR is not just an intuitive field and is imperative to encourage it as a systematic body of knowledge. Human Resources have evolved from being a support function to one of the key drivers of an organization’s success and organizational change. Keeping in spirit the driving principle of Human Resources to foster and further the “human” in […]

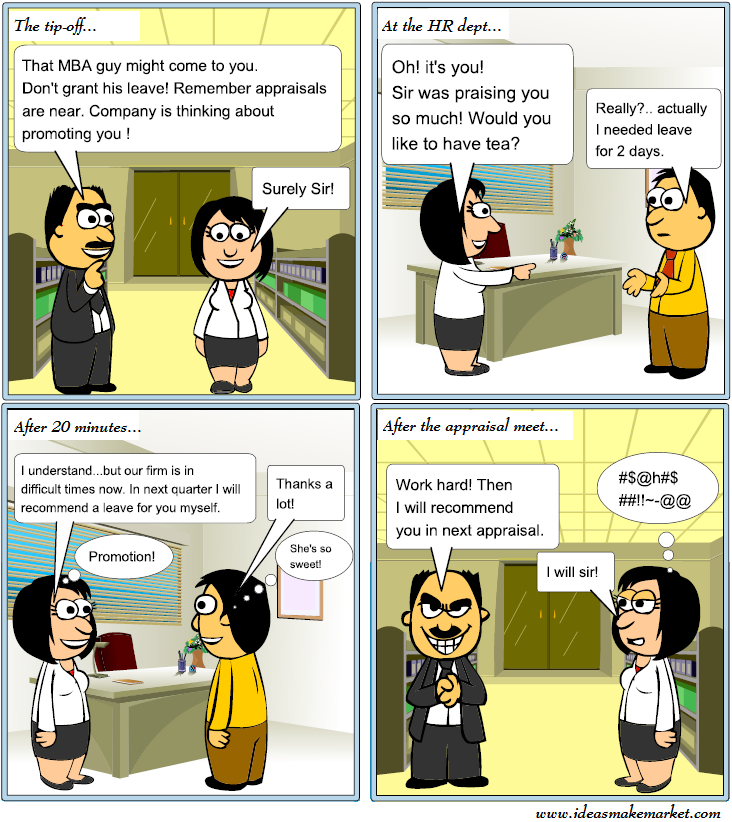

IMM Comics: The HR story

Our MBA guy desperately needs the leave ! He approaches the HR department- Does his wish get fulfilled ? How does the HR handle it? Let’s find out! Food for thought: Is the story same at your workplace? Tags: hr MBA office life