The Mahindra Group has been well known for its strength and dominance in the automobiles and farm equipment sector. However its association with the IT industry dates back to 1986, when Tech Mahindra was started. The company got itself listed in the stock exchange in 2006.

The company primarily caters to the telecom sector and nearly 35% of its revenues of 1.3 billion USD come from one single client: British Telecom. In fact the company started as a joint venture with BT which presently has about 9.1% share in the company down by 14.1% stake sale in August this year for a consideration of 1395 crores. The company has recently been in the news for its proposed merger with Mahindra Satyam- a company almost equal in size with revenues of 1.2 billion USD. The merger will lead Tech Mahindra to become the fifth largest IT major in India with combined revenues of 2.5 billion USD. The existing share holders will get 2 shares of Tech Mahindra for 17 shares of Mahindra Satyam in an all stock deal, however the record date has not yet been announced.

Key Financials of Tech Mahindra:

|

Standalone

|

Consolidated

|

|

|

TTM EPS (Rs)

|

36.50

|

90.70

|

|

TTM Sales (Rs. Cr.)

|

5503.66

|

5740.63

|

|

BVPS (Rs.)

|

279.18

|

328.42

|

|

Reserves (Rs. Cr.)

|

3435

|

4064

|

|

P/BV

|

2.86

|

2.43

|

|

PE

|

21.86

|

8.80

|

The access to Mahindra Satyam’s clientele and expertise will allow Tech Mahindra to enter into new domains like enterprise solutions and also diversify its sector portfolio. Telecom which forms more than 70% of revenues will contribute about 45% in the merged company and BT will have about 17% share of revenues. The financial risks in this merger can also be seen in an estimated penalty of INR 3000 crores that Mahindra may end up paying in lawsuits over time due to financial fraud committed by erstwhile Satyam computers.

Tech Mahindra, however, is not limited to this merger in its acquisition spree lately. The company recently acquired the BPO service wing of Hutchison, Hutchison Global Services, for Rs 484 crores. Moreover as part of the deal, the clientele of HGS has agreed to procure services worth 845 million USD for the next 5 years. The company has recently also been in talks to acquire the mobile value added services company, Comviva, of Indian telecom major Airtel for a sum of Rs.750 crores, which will give Tech Mahindra a significant position in this growing market segment. Comviva had reported a net operating profit of INR 60 crores and total revenues of INR 380 crores in the last financial year (2011-12). Tech Mahindra already has a presence in VAS segment through its joint venture with Motorola, CanvasM, which is widely believed to be mostly targeted at mobile commerce.

If we closely analyse the range of acquisitions that Tech Mahindra are doing, all of them are in synergy with its existing line of businesses. Tech Mahindra- Mahindra Satyam merger is just a small piece in the global aspirations of this company. In fact, the company is increasingly looking for more buyouts as it consolidates its position further. However the company is also increasing debt in its accounts- it had Rs 886 crores in debt and Rs 280 crores in cash in its accounts as on June 30th this year. The growing acquisition spree will only increase its leverage further. For the moment though, this appears to be a company to watch out for! Or will it be another tortoise and hare race ?

Food for thought: Is Tech Mahindra increasingly becoming reminiscent of Mahindra Group’s acquisition strategy over the years?

You might like reading:

Internship Diaries – Is internship really important ?

Ask any first year MBA student what is highly imperative to come out from an MBA programme, you will receive a mutual answer – “Summer Internship”. Although B-Schools do accentuate on the aspect of academics and learning which will ultimately drive you ahead in your occupation, but for a first year graduate getting placed for summers is in itself also […]

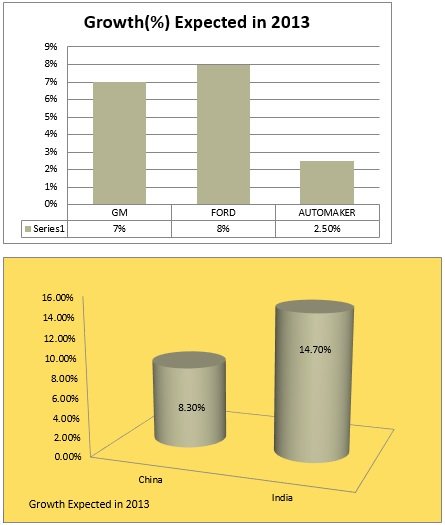

Analysing the Automobile Industry

Analysis of Automobile sector The word automotive was created from the Greek word “autos” meaning self and Latin word “motivus” meaning motion to represent any form of self-driven vehicle. The term was proposed by Elmer Sperry. It is one of the world’s most important sectors by revenue. Before we move on to analyzing the trends of the industry and […]