|

Who can claim exemption

|

An individual or a Hindu undivided family

|

|

Which specific asset is eligible for exemption

|

If a residential house property (long-term) is transferred

|

|

Which asset the taxpayer should acquire to get the benefit of exemption

|

Exemption is available if another residential house is purchased or constructed

|

|

What is time limit for acquiring the new asset

|

Purchase – Residential house can be purchased within 1 year before transfer or within 2 years after transfer.

Construction – Residential house can be constructed within 3 years from transfer.

In the case of compulsory acquisition, these time-limits shall be determined from the date of receipt of compensation (original or additional)

|

|

How much is exempt

|

Investment in the new asset or capital gain, whichever is lower.

|

|

Is it possible to revoke the exemption in a subsequent year

|

If the new asset is transferred within 3 years of its acquisition exemption will be taken back. For calculating capital gain on transfer of new asset, cost of acquisition will be calculated as (original cost of acquisition – exemption availed under section 54).

|

The tax payer can acquire the new asset by withdrawing from the deposit account. But the new asset should be acquired within the above mentioned time-limit mentioned. If the deposit account is not fully utilized for acquiring the new asset, the unutilized amount [but in case of section 54 and 54F when the 3- year time limit expires], will be taxable as short-term/long-term capital gain depending upon the original capital gain. The unutilized amount can be withdrawn by the tax payer after the expiry of the aforesaid time-limit. If the tax payer dies before the expiry of specified time-limit (for making investment in the new asset), then unutilized amount paid to the legal heirs is not taxable in the hands of recipient.

|

Residential house property situated in Delhi

|

Mr. Sinha

Rs.

|

Mr. Goyal

Rs.

|

|

Date of transfer of the property

|

July 10, 2011

|

September 19, 2011

|

|

Date of purchase of the property

|

October 6, 1984

|

April 10, 1983

|

|

Sale consideration received

|

18,00,000

|

14,50,000

|

|

(Stamp duty value)

|

(20,00,000)

|

(17,50,000)

|

|

Cost of acquisition

|

50,000

|

90,000

|

|

Expense on transfer

|

10,000

|

6,000

|

|

Date of Purchase

|

December 20, 2011

|

March 1, 2011

|

|

Cost of acquisition

|

20,00,000

|

16,00,000

|

|

Sale consideration (i.e., stamp duty value)

|

20,00,000

|

|

Less:

Indexed cost of acquisition [Rs. 50,000 X 785 / 125]

|

3,14,400

|

|

Expenses on transfer

|

10,000

|

|

Balance

|

16,76,000

|

|

Less: Exemption under section 54 [amount of investment in new residential property, i.e., Rs. 20,00,000 or amount of capital gain, i.e., Rs. 16,76,000, whichever is lower]

|

20,00,000

|

|

Long-term capital gains chargeable to tax for the assessment year 2012-13

|

NIL

|

You might like reading:

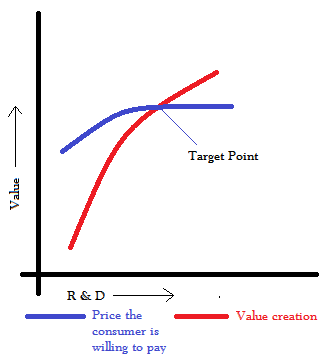

Value vs. Price: Which parameter is more important ?

There is lot of talk of value for money these days. In fact you get to hear it from every retailer that you visit. How do you actually create value and is there any limit to the value that should be created ? When we talk about value it is all about the perception in the mind of the […]

Promote for discount ?

Sales personnel get commission for marketing a product and getting it sold to the customer. But can the customer also be asked to market it?Well I am not talking about word of mouth marketing. What I am talking about is the customer being made to endorse the same product, a product of a sister company or perhaps even a third […]