Dell is undoubtedly one of the most innovative companies in the arena of technology. It mesmerised the world with its custom built model in an age when factory production of PCs and laptops were the norm. In fact, the brand Dell has got synonymous with quality and is today the third largest player in the PC market next only to HP and Lenovo. So why did it suddenly decide to turn private?

Dell ranks 44th in the list of fortune 500 companies with revenue exceeding 63 billion USD in 2012. The company was started in the year 1984 by Michael Dell after whom the firm is named. While revenues remain significantly high, there is little doubt that its growth has flattened with increasing downward pressure on its profit margin that has fallen from nearly 5% in Aug 2012 to just about 3.5% in Nov 2012, thereby indicating a negative outlook and possibility for the stock prices to trade at low values in the short run in the event no offer was made. If we analyse the movement of the share price over the last 3 years, the share price was highest at $18.36 in February 2012 and the present offer for taking the company private is at $13.65. If we consider 5 year data, we can clearly see that the offer price is nearly half of its 5 year high of $26.

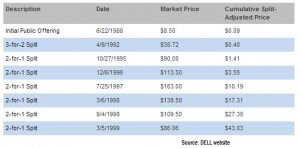

If we look at the story of this $1000 start-up, it has been one wavy ride. The company first got itself listed in the year 1988 to raise a capital of 30 million USD. During the course of time, it had several stock splits and at one point the company was valued at over 100 billion USD, making it one of the hot technology stocks. The firm was trading at a market capitalisation of 19 billion USD (at $10.88 per share), before the present offer at 25% higher than this value at 24.4 billion USD. The company is presently trading quite close to the offer price indicating the market sentiment that share price is unlikely to improve over these levels.

Michael Dell, the founder has about 16% holding in the company which will be transferred to the new company that will be formed, which will retain him as the CEO. The deal is being financed by several parties: Michael Dell himself, Microsoft, PE firms Silver Lake and MSD Capital (PE firm that manages the Dell family assets) and financial institutions like Bank of America, Barclays and Credit Suisse. The timing of this deal is quite significant as it comes at a time when the PC industry is set to decrease by 3% (according to a Gartner report) this year due to increasing influence of the tablet market. Silver Lake is one of the renowned PE firms that takes special interest in leveraged buyouts of large listed enterprises in technology sector whereas MSD capital is the PE firm that was started by Michael Dell himself.

The role of Microsoft is apparently the most interesting one. Microsoft is increasingly looking to leverage itself on well-known giants currently going through a downturn, a similar case can be found with respect to Nokia which has killed its Symbian OS in favour of Windows Mobile. Being the third largest player in PC hardware, significant interest in DELL will allow Microsoft to popularise its Windows 8 platform (and future ones) and also have a larger say in product design especially for the tablet market.

DELL is increasingly looking at emerging as a strong software service company separate from its hardware business. Its spree of acquisitions over the last 3 years total about 9 billion USD. Some of the companies that it has acquired are Credant Technologies (data protection solution), Gale Technologies (Infrastructure software), Quest software ( database management) and Wyse Technology ( Cloud computing) all indicate its desire to transform itself and to look at software service industry to drive up the margins. Taking the company private, will enable DELL to focus on this transformation without worrying about analyst opinions affecting stock prices based on quarterly results.

DELL was one of the major beneficiaries of the PC boom as it was able to spot the trend early whereas it failed to spot the potential of the mobile market. It subsequently launched mobile devices, but it was apparently too late to enter the market. Perhaps, the growing tablet market and lucrative software service sector are the way forward for DELL in the changing dynamics of IT industry. The bigger question is: Will this start a new chain of consolidation in the PC industry?

You might like reading:

How 2011 defined the changing face of leadership

The year 2011 can be summed up in what Wael Ghonim said –“It’s a mistake of every one of them in power who doesn’t want to let go for it”. 2011 was a tumultuous year. It was difficult to imagine an octogenarian lead the thought process of the common Indian man towards socio-political reforms or a 30 something Google employee […]

Think Tank 2 released ! Grab it now !!

Our Ebook “The Think Tank” Volume 2 is released now! Some features: *51 Original articles *Articles from IIT, IIM, NIFT alumni,Consultants, Project Managers and lots more *Articles from authors in US and UK *Completely free ! Grab it now !! Tags: business ebook free thinktank