[The article is written by Mr. Varun Joshi. He is the Managing Partner of AV Realty Corp. and is a keen follower of Indian equity market.]

You might like reading:

Is Earth a safe place to live?

“What’s the use of a fine house if you haven’t got a tolerable planet to put it on?” -Henry David Thoreau, Familiar Letters The quote above speaks volumes about the topic in hand and points us at the right direction -our roots of existence, the very cause that lets us survive- the environment we live in, our planet earth, the […]

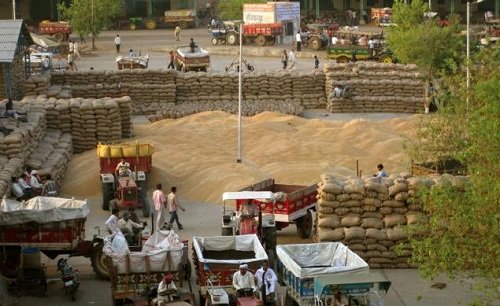

Operational optimization at APMC Procurement

Abstract: Agri-business, as the present scenario is concerned follows decade old practices of procurement, packaging and dispatch. Still, all the jobs are done manually by labourer varying from filling of sacks with grains to dispatch of the sacks. Taking into consideration the acute shortage likely to be faced by this sector we need to come up with innovative and automatic […]