An external commercial borrowing (ECB) is an instrument used in India to facilitate the access to foreign money by Indian corporations and PSUs (public sector undertakings). ECBs provide an additional source of funds to the companies allowing them to supplement domestically available resources and take advantage of lower rates of interest prevailing in the international financial markets. ECBs have become very popular amongst the Indian companies, during the past few years due to the limitations in the Indian debt market in the form of short maturity period and high rate of interest.

Types of ECBs

At present, Indian companies are allowed to access funds from abroad in the following methods:

(i) External Commercial Borrowings (ECB) refer to commercial loans in the form of bank loans, buyers’ credit, suppliers’ credit, securitized instruments (e.g. floating rate notes and fixed rate bonds, non-convertible, optionally convertible or partially convertible preference shares) availed of from non-resident lenders with a minimum average maturity of 3 years.

(ii) Foreign Currency Convertible Bonds (FCCBs) mean a bond issued by an Indian company expressed in foreign currency, and the principal and interest in respect of which is payable in foreign currency

(iii) Preference shares (i.e. non-convertible, optionally convertible or partially convertible) for issue of which, funds have been received on or after May 1, 2007 would be considered as debt and should conform to the ECB policy. Since these instruments would be denominated in Rupees, the rupee interest rate will be based on the swap equivalent of LIBOR plus the spread as permissible for ECBs of corresponding maturity.

(iv) Foreign Currency Exchangeable Bond (FCEB) means a bond expressed in foreign currency, the principal and interest in respect of which is payable in foreign currency

Why companies opt for ECBs

i. Foreign currency funds: Companies need funds in foreign currencies for many purposes such as, paying to suppliers in other countries etc that may not be available in India.

ii. Cheaper Funds: The cost of funds borrowed from external sources at times works out to be cheaper as compared to the cost of Rupee funds.

iii.Diversification of investor’s base: Another advantage is the addition of more investors thus diversifying the investor base

iv. Satisfying Large requirements: The international market is a better option in case of large requirements, as the availability of the funds is huge when compared to domestic market.

Corporate can raise ECBs from internationally recognised sources such as banks, export credit agencies, suppliers of equipment, foreign collaborators, foreign equity holders, international capital markets etc.

The government through the ECB policies is trying to nourish 2 sectors:

i. Infrastructure

ii.SME

The policies do not require any approval for investment under a limit in these 2 sectors. Thus it is easy to acquire foreign loans for such enterprises. Apart from that, the low cost of funds in the global market provides the small and medium enterprises funds at low costs thus bringing in more money in these sectors

Benefits of ECBs over other sources of funds

1. Cost of raising ECBs is much lower than that of domestic borrowings

2. Global financial market is a much bigger source of credit.

3. Foreign lenders provide far more flexibility in terms of providing security for ECBs.

Disadvantages of ECBs

Since the funds are raised through ECBs in foreign currency and the interest & redemption proceeds are also payable in the foreign currency, the issuing company has to hedge its foreign exchange exposure, which involves expenditure. In case the company opts to keep its foreign exchange exposure unhedged, it carries a huge risk due to fluctuation in foreign exchange rates. RBI has also acknowledged this problem and has instructed the banks to put in place a system for monitoring the unhedged foreign exchange exposure of small and medium enterprises.

The funds raised through ECBs have to be utilized in accordance with the end uses permitted under the guidelines; as such these funds cannot be utilized for working capital or general corporate purposes.

Rules and Regulations regarding ECBs

The DEA (Department of Economic Affairs), Ministry of Finance, Government of India along with Reserve Bank of India, monitors and regulates ECB guidelines and policies.

The ECB policy basically deals with the following aspects:-

1.Eligibility criteria for accessing international financial markets

2.Total quantum / limit of funds that can be raised through ECBs

3.Maturity period and the cost involved

4.End use of the funds raised

5.Conversion of ECBs into Equity

ECB can be accessed under two routes, viz.; (1) Automatic Route outlined (2) Approval Route

ECB for investment in real estate sector, industrial sector, especially infrastructure sector in India, are under Automatic Route, i.e. do not require RBI / Government approval. In case of doubt as regards eligibility to access Automatic Route, applicants may take recourse to the Approval Route

i) Eligible Borrowers

a) Corporates, including those in the hotel, hospital, software sectors and Infrastructure Finance Companies (IFCs) except financial intermediaries, such as banks & other financial institutions (FIs), are eligible to raise ECB. Individuals, Trusts and Non-Profit making organizations are not eligible to raise ECB.

b) Units in Special Economic Zones (SEZ) are allowed to raise ECB for their own requirement. However, they cannot transfer or on-lend ECB funds to sister concerns or any unit in the Domestic Tariff Area

c) Non-Government Organizations (NGOs) engaged in micro finance activities are eligible to avail of ECB

d) Micro Finance Institutions (MFIs) engaged in micro finance activities are eligible to avail of ECBs

ii) Recognised Lenders

Borrowers can raise ECB from internationally recognized sources, such as:

a) International banks b) international capital markets c) multilateral financial institutions (such as IFC, ADB etc. d) export credit agencies e) suppliers of equipments f) foreign collaborators and g) foreign equity holders

iii) Amount and Maturity

a) ECB above USD 20 million or equivalent and up to USD 750 million or its equivalent with a minimum average maturity of five years.

b) ECB up to USD 20 million or its equivalent in a financial year with minimum average maturity of three years.

iv) All-in-cost ceilings

All-in-cost includes rate of interest, other fees and expenses in foreign currency except commitment fee, pre-payment fee, and fees payable in Indian Rupees.

|

Average Maturity Period

|

All-in-cost Ceilings over 6 month LIBOR

|

|

Three years and up to five years

|

350 basis points

|

|

More than five years

|

500 basis points

|

v) End-uses

a) ECB can be raised for investment such as import of capital goods, new projects, modernization/expansion of existing production units in real sector – industrial sector including small and medium enterprises (SME), infrastructure sector and specified service sectors, namely, hotel, hospital, software in India.

b) For first stage acquisition of shares in the disinvestment process

c) Interest During Construction (IDC) for Indian companies which are in the infrastructure sector

d) For lending to self-help groups or for micro-credit or for micro finance activity including capacity building by NGOs engaged in micro finance activities.

e) Payment for Spectrum Allocation

vi) End-uses not permitted

The borrowings shall not be utilized for any other purpose including the following purposes:

(a) For on-lending or investment in capital market or acquiring a company in India by a corporate [investment in Special Purpose Vehicles (SPVs), Money Market Mutual Funds etc., are also considered as investment in capital markets].

(b) for real estate sector

(c) for working capital, general corporate purpose and repayment of existing rupee loans.

Key issues with ECB policy

Domestic loan refinancing by ECBs is not available to companies in sectors such as retail, construction, services etc.

1. Similar policy available for companies developing sea ports, airports, roads, bridges and power. These sectors require cheap source of funding to remain competitive in global markets

2. Use of ECBs for on-lending is not allowed. Inability of wholly owned subsidiaries(WOSs) and Special Purpose Vehicles (SPVs) to raise cost effective debt due to lack of strong balance sheet. SPVs and WOSs prevalent in infrastructure sector which are capital intensive

3. Absence of full capital account convertibility and thus a cap on rupee expenditure of ECBs

Analysis of ECBs

Data

We have considered BSE 500 companies as our sample for all the calculations as we believe BSE 500 covers all the sectors and is a good representative of all the listed companies. We have excluded banking and financial institutions since their need for capital to lend make them fundamentally different from other sectors.

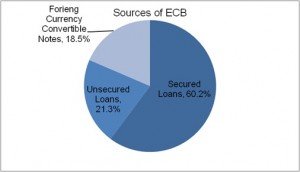

Sources of ECBs

Our analysis reveals that almost 60% of external commercial borrowings is through Secured Loans. Foreign Currency Convertible Notes form about 18% of the total external commercial borrowings.

The interest rates for secured loans are lower than those for unsecured loans and hence they are preferred by companies to raise capital. For banks secured loans are safer and hence preferred to unsecured loans.

FCCBs have lower interest rates than loans, however, there is a threat of equity dilution if they are converted to equity which lowers their appeal to borrowers. Also, in the present scenario where company stocks have been battered, the lenders would not prefer FCCBs.

Which Sectors prefer ECBs

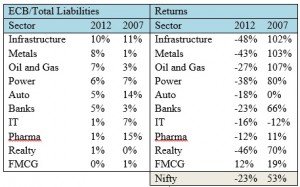

We analyzed the ECB borrowing across sectors in 2007 and 2012. The idea was to see if there was a preference for ECB within some sectors or was it dependent on market conditions.

Source: ACE Equity, Student Research

The analysis reveals an interesting point that sectors which are performing well generally have lower ECB. For example, Auto and Pharma which were laggards in the 2007 bull market had ECB/Total Liabilities of 14% and 15% respectively. However, as the performance of these sectors relative to the market improved in 2012, their ECB/Total Liabilities reduced to 5% and 1% respectively. Infrastructure and Power are an exception to this trend.

We believe the reason for this trend is that sectors which are not performing well have to avail domestic credit at unfavourable stringent terms and so they prefer ECBs which are available at comparatively favourable terms.

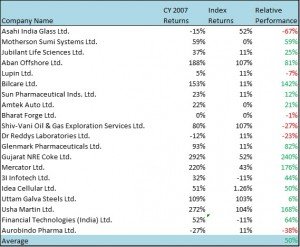

Impact of ECBs on stock performance of companies

We compared the stock price of companies with highest ECB/Total Liabilities ratio with their respective indices.

We did this comparison for 2 periods, calendar year 2007 which was a bull market and calendar year 2011 which was a bear market.

Bull Market

During bull markets, companies have high profits and face less difficulty in meeting their interest obligations. Also, the rupee is stronger relative to dollar which reduces the obligations of ECBs. This fact can be seen in the stock price performance of companies with high ECB exposure as they outperformed their respective indices by 50%. The outperformance was seen across majority of the companies as 14 out of the 20 companies outperformed their respective industry indices.

|

|

Source: Ace Equity, Student Research

|

Bear market

During the bear market of 2011, the rupee depreciated heavily, the impact of which was clearly seen in the stock price performance of companies with high ECB exposure. These companies unperformed their respective industry indices by 18%. 15 out of the 20 companies underperformed their respective industry index.

|

|

Source: Ace Equity, Student Research

|

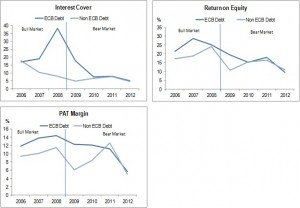

Impact of ECBs on financial performance of companies

To measure the impact of ECB on financial performance of companies we compared the financial parameters of companies with ECB exposure (55 companies) to those which had only domestic debt (159 companies). We excluded debt free companies from our analysis as we specifically wanted to understand the impact of ECB debt as compared to domestic debt.

We use the following financial parameters for measuring the impact

Interest Cover : Directly identifies a company’s ability to meet its interest obligations

PAT Margin : Interest obligations have a direct impact on the PAT margin of a company

Return on Equity : To analyze the impact on Shareholder equity

Since we based our analysis on a large number of companies across all the different sectors, we believe the unsystematic risks of individual companies won’t affect the conclusions of our research.

The financial performance indicators reveal a trend that reinforces the conclusion of stock price performance. During bull markets, there is no stress on the financial performance of companies with ECB debt. However, during bear markets, as profits begin to fall and rupee depreciates, the Interest Cover, Return on Equity and PAT margin of companies with high ECB exposure reduces greatly indicative of the deteriorating financial condition of such companies.

Regression Modelling

Impact of ECB on Market Capitalization of Companies

We have taken the ECB data for BSE500 companies and modelled their market price as a function of

i. ECB as a % of total liabilities

ii. Return on Equity

iii.Book Value Per Share

iv.Earnings Per Share

v.Enterprise Value/EBITDA

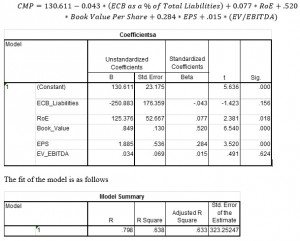

The model is as follows

Since the R Square statistic is relatively high (greater than 0.6), the model is a relatively good fit. We can also conclude that RoE, Book Value Per Share and EPS have a significant impact at 95% level of confidence on the stock price (since p value<0.05).

However, ECB do not have a significant impact on the current market price of companies at 95% level of confidence, as the p value of 0.156>0.05. However, we can see in the model that as ECB as a % total liabilities rises, the current market price comes down.

Correlation between Price to Book Value and External Commercial Borrowings

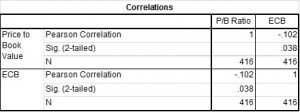

We analysed Pearson’s coefficient of correlation between Price to Book Value and External Commercial Borrowings.

The price to book value ratio and ECB are negatively correlated (Pearson’s coefficient of correlation is -0.102) Thus, the stock market assigns a discount to those companies with a high proportion of ECB borrowings

We can see there exists a significant correlation (since p value<0.05) between ECB and the price to book value ratio at 95% level of confidence.

Redemption Pressure

FCCBs will not be converted into equity if the stock is trading at a discount to the FCCB conversion price. In depressed equity markets, this is often the case. This can be excess redemption pressure on companies. As seen in the following table, this is often the case:

In such a scenario, the company which has issued the FCCB can face severe liquidity and solvency issues as it forced to repay its external debt commitment (while it had planned to convert into equity at time of redemption). In India, there is approximately 20% default rate for FCCBs. Under such a scenario of default, the company may

i.Refinance the FCCBs by rolling over the bonds with later maturity dates, often at higher coupons

ii.Lower the conversion-to-equity price and further dilute promoter holdings

iii.Get bondholders to accept a haircut (only a partial repayment of their principal)

FCCB Case Study: Suzlon Energy- India’s biggest FCCB Default

Suzlon raised $200 million through dollar convertible bonds in 2007 and the amount outstanding on this tranche was $121.4 million with a conversion price of Rs97.26 per share. The second tranche of convertible bonds worth $20.8 million and issued in 2009 at a conversion price of Rs76.68. Suzlon had also raised $90 million through dollar convertible bond on July 24, 2007 and $175 million on April 12, 2011. Both the tranches would come for redemption after five years from the date of issue.

As on June 30, 2012, Suzlon on standalone basis had gross debt of Rs 13,477 crore that includes Rs 2,053 crore loan for acquisitions, Rs 3,641 crore FCCBs and Rs 7,783 crore of working capital, capex and other loans. Promoters held 52.76% of Suzlon Energy as on June 30.

When the markets were at their peak in 2006-2008, FCCBs were the flavour of the season as many companies found it a cheaper way to raise money compared to rates they were getting in the domestic market. The companies believed that since their shares would only rise, the bonds would be converted into equity instead of being redeemed.

Economic conditions weakened and their expansion plans did not play out the way they were expected to.

Stock has plunged about 83% in the last three years, wiping out $2.5 billion from its market value. The share price that tanked to Rs16.15 has made conversion of the debt into equity meaningless, rendering repayment the only option. The bondholders have rejected a four-month extension sought by the company & hence Suzlon Energy, the debt-laden wind turbine maker, is set to default on redemption of over $200 million foreign currency convertible bonds (FCCBs). Suzlon did not get extension as the company could not offer a concrete road map that how it will pay back the loan after four months. In July, Suzlon redeemed $360 million of FCCBs after bondholders agreed to a 45-day deadline extension. A consortium of banks including SBI, Bank of Baroda and ICICI Bank gave loan to Suzlon in July, 2012 that saved it from default. But this time it is difficult as the company has very little to offer as its share prices are battered; very few assets are left to be offered on the block and revenue realisations are low due to the slowdown in US and European turbine market.

The combination of higher domestic borrowing costs and risk aversion among global banks has made it tougher for the smaller and mid-sized Indian companies to raise funds to pay bondholders. A total of 21 of the 56 companies holding an outstanding of $5 billion foreign currency convertible bonds (FCCBs) maturing in 2012 are likely to default on redemption payment, according to an S&P report.

Impact of ECB on India’s External Debt

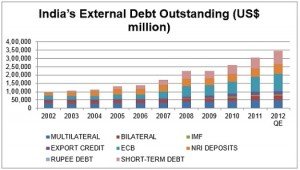

External debt of a country indicates contractual liability of residents to non-residents. At the end of Mar 2012, as per RBI estimates, the total external debt for India (including both long and short term debt) stands at $345 billion. The debt was up 13% from $305 billion at the end of March 2011. The rise in External Commercial Borrowing was one of the major contributors of the rise in external debt accounting for 39.7 per cent of the increase in total debt.

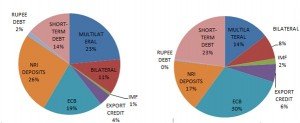

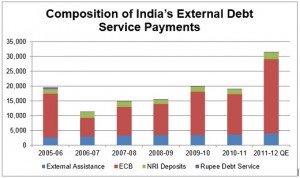

As we can see from the below graph, the composition of India’s external debt is undergoing a major change wherein the contribution of multilateral and bilateral debt is falling while that of ECBs and NRI deposits is increasing sharply. Between 2006 and 2012, ECBs in India has grown at a 25.7% while total external debt has grown at 16% CAGR during the same period.

As a result, the contribution of ECB in the total external debt has increased from 19% in 2006 to 30% in 2012 while that of multilateral and bilateral debt has fallen from 23% to 14% and 11% to 8% respectively. This changing structure indicates the Indian economy is becoming more market oriented and is becoming integrated with the world economy.

However, the increase in ECB gives rise to concerns in case of depreciation of rupee as it leads to a higher debt service burden (in rupee terms) that adversely impacts the profitability and balance sheet of companies.

Debt Service

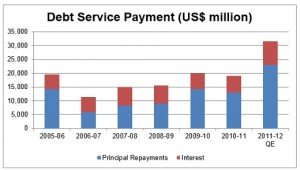

Debt Service payments witnessed a sharp rise in 2011-12 from 2010-11 levels. The gross debt service payments increased by more than 65% from $19.1 billion in 2010-11 to $31.5 billion in 2011-12. Prior to 2011-12, the debt service payments remained in the range of $11-$19 billion. This rise in debt service payments was mainly due to higher costs of ECBs.

Looking at the composition of debt payments, we observe that debt payments towards ECBs continue to contribute the most significant portion of total debt payments. Also, the contribution of payments towards ECBs has increased significantly in 2011-12 to 80% from 71.3% in 2010-11. It may be noted that the repayments towards short-term debt are not included in the total debt payments (as per the international practice).

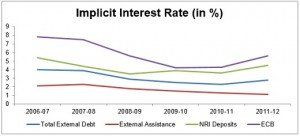

As discussed above, the rise in debt payments in 2011-12 is mainly attributable to the rise in the servicing costs of ECBs. This can also be observed by looking at the implicit interest rates for different debt components. Implicit interest rate is estimated as:

Implicit Interest Rate = Interest payments during the year

_________________________________

Debt outstanding at the end of previous year

During 2011-12, the implicit interest rate for the total debt increased from 2.3% to 2.8% mainly caused by rise in implicit interest rate for ECB which stood at 5.6% in 2010-11 as against 4.3% in 2011-12.

Future Outlook

An issue for the country is that while ECBs can be a blessing for some companies, it raises the issue of sustainability of external debt at the macro-level.

With ECBs becoming attractive, they now account for 30% of the total debt; they could rise as long as our interest rate differential with those in the euro market is wide. The back-up in terms of reserves would increase primarily from hot money FII flows in the future, which may not be the perfect match. This, coupled with the forex risk, in the absence of hedging would be the two concerns going ahead.

We can expect an increase in demand for ECBs amongst the Indian Companies because of the following reasons:-

1. Plans for Huge Spending on Infrastructure projects

2. Domestic interest rates are moving upwards

[The article has been written by Keyur Vinchhi. He is an MBA(2011-13 batch) in Marketing & Finance from MDI Gurgaon and has previously worked in L&T for about two years. ]

You might like reading:

SIBM Pune Placements 2016 : 77 Recruiters on campus

As a premier institution of India’s B-School fraternity, SIBM Pune continued to enjoy immense confidence of the industry as testified by the phenomenal placement season for the batch of 2014-16. Campus Recruitment Programme 2015-16 at SIBM Pune concluded on a high note with record number of job offers secured by students in myriad sectors viz. FMCG/ FMCD, Consulting, E-commerce, BFSI, […]

IMM Comics: Problems of MBA guy in inflation

Our MBA guy faces lots of problems due to inflation. Are you also facing them? Tags: inflation problems