Indian pharmaceutical manufacturer BDR Pharma has recently been in the news. The company is a known manufacturer of generic drugs and sells the drug Remdesivir which has been known to be effective in the fight against covid-19. It is believed that Private Equity firms such as Carlyle, Warburg Pincus and TA Associates are eyeing a stake of about 15% in the Indian pharma firm with a valuation of over 1 Billion USD. It is to be noted that the company also manufactures drugs like Favipiravir (another drug used for treating Covid-19) and approximately 50% of its revenue comprises of selling generic drugs pertaining to critical care, oncology and gyaneocology segments.

The company follows an interesting strategy of manufacturing off-patented drugs at a fraction of the price of the original drug. In 2013, it produced the generic version of J&J’s prostrate cancer drug Zytiga at less than 25% of the original price. Apart from manufacturing for leading pharma companies like Sun Pharmaceuticals and Cipla, the life sciences division of the company also focuses on new formulations and manufacturing ingredients.

In FY 21, the company has posted revenue of INR 1200 Cr and operating earnings of INR 400 Cr implying a steady operating margin of 33.33%. The expected valuation of INR 7500 Cr, implies an EV / Operating revenue of 6.33. If we compare this ratio with comparable firms such as Dr. Reddys (5.6) , Sun Pharma (11.6) and Cipla (4.6), it seems to be a fair valuation. However, one must remember that BDR Pharma is not a comparable firm either in terms of scale nor in terms of revenue. Recently PAG has acquired controlling stake in Acme Foundation, a leading contract manufacturing firm for pharma products.

The global outsourcing pharma market is valued at approximately 90 billion USD and is expected to reach 117 billion USD by 2023. It is this opportunity for growth which is driving the PE interest in Indian pharma. If we add on to this the market potential of an economy like India, it is natural that PE funds are finding BDR Pharma as an attractive proposition both for manufacturing as well as generic versions for local market. Furthermore, the booming IPO market in India looks attractive as a possible exit strategy for the PE firms post 2-3 years of their investment. The upcoming IPO of Glenmark Life Sciences is also expected to trade at a premium of at least 20% which makes this an important sector to watch out for !

Tags: BDR Pharma PE pharma privateequityYou might like reading:

Promote for discount ?

Sales personnel get commission for marketing a product and getting it sold to the customer. But can the customer also be asked to market it?Well I am not talking about word of mouth marketing. What I am talking about is the customer being made to endorse the same product, a product of a sister company or perhaps even a third […]

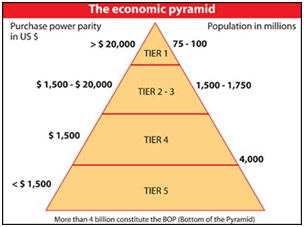

Marketing to the Bottom of the Pyramid

The bottom of the pyramid (BoP) refers to the four billion poor people in the world. They have no access to global markets and thus, have to pay more for goods and services. Big companies don’t see them as viable markets. In fact, this group represents the biggest market opportunity in the world if companies can offer affordable products and […]