India’s sovereign wealth fund NIIF is reportedly in talks to make its first investment in the Indian startup ecosystem in kidswear retailer FirstCry. Let us try to understand the structure of NIIF. The National Investment and Infrastructure Fund (NIIF) was started in 2015 and is headquartered in Mumbai. It presently manages a corpus exceeding 4 Billion USD. Among domestic investors, the notable ones include HDFC Bank, Axis Bank, Kotak Mahindra Life and ICICI Bank. Foreign investors include Abu Dhabi Investment Authority (ADIA), Asian Development Bank and Canada Pension Fund Investment Board (CPFIB), the largest pension fund in Canada. According to sources, the Govt of India owns about 49% of the wealth fund.

NIIF consists of three types of funds presently:

1. Master Fund

The Master Fund is an infrastructure fund which invests mainly in core infrastructure sectors such as roads, ports, airports, power etc. This is focused on investing in mature businesses with long-term track record often operating in regulated environments or under concession or long-term agreements. There is also a joint venture named Hindustan Infralogs between the fund and DP World, a leading Emirati logistics company.

2. Fund of Funds

The Fund of Funds (FoF) invests through India-focused equity fund managers who have a strong track record of managing investments successfully. Focus areas include Green energy, housing and infrastructure projects. Since 2018, there has been a partnership with UK Government to launch the Green Growth Equity Fund to focus on clean energy, water and waste management projects in India.

3. Strategic Opportunities Fund

The Strategic Opportunities Fund (SOF) is registered as an alternative investment fund under SEBI and is targeted towards investing in Equity and Equity linked instruments. The SOF is recently in news over possible investments to the tune of 150-200 mn USD in FirstCry at an expected valuation of about 2.5 Billion USD.

The expected investment in FirstCry

This is the first time that India’s wealth fund has looked at making any form of investment in India’s booming internet economy. The sale is expected to be through secondary market with some of the existing shareholders including Softbank expected to sell part of their existing stake. In the month of April, NIIF had also announced an investment of 300 Mn USD in Manipal Hospitals in the healthcare segment.

Why is the deal significant?

Pune based FirstCry is expected to have an IPO in the next 12-18 months which will help in unlocking the value for all the shareholders. An investment at this time will increase the investor confidence as the company will now technically have a sovereign backing to scale it to the next stage. Online retail in India is expected to grow in double digits and it looks as a good investment for NIIF to hold in its portfolio considering the company also owns the logistics firm Xpressbees and has physical outlets as well.

Sovereign funds investing in internet companies is not new. However, it is a bold step in the right direction for the Indian startup ecosystem.

Tags: FirstCry investment NIIF sovereign fundsYou might like reading:

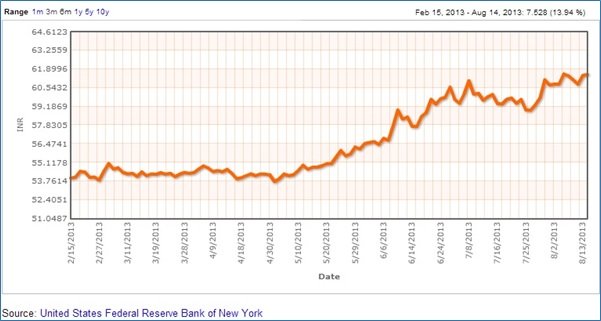

Local currency depreciation – Do we have a panacea?

When Indian currency is witnessing the worst ever depreciation, it remains interesting to explore what measures could help finance ministry to contain the same. As depicted in the diagram, Indian Rupee has depreciated by almost 13-14% against dollar and that has further jeopardised the actions of Indian Finance Ministry which was juggling hard already to improve India’s GDP, which managed […]

Analyzing the perspectives of business anthropology

I can’t wait to tell you that today I got a new perspective to the way I look at the word ‘anthropology’. From years, I believed, ‘anthropologists’ study humans and human societies. So I believed, them to be working closely with the archeologists, making theories on the evolution of mankind and writing articles on how society developed, how we started […]