Leader does and Industry follows. Reliance and SAFT deal might have raised the eyebrow of many Industry followers. But the USD 40 million deals between Reliance Jio Infocomm and Paris-based battery manufacturer SAFT opened up the Indian telecom industry for a sustainable future. SAFT will supply specialized lithium-ion (Li-ion) batteries, which will be used at Reliance mobile tower sites for meeting power requirement.

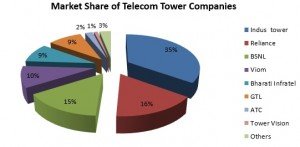

With ~76% of teledensity and with ~650,000 mobile towers, India is becoming a major market for billion dollar companies. India’s telecom sector is now the second largest in the world, and the fastest growing. Currently the annual revenue of the industry is around INR 1.36 trillion. To promote this sector earlier this year government approved telecom towers ‘Infrastructure’ status and already allowed 100% FDI.

It is estimated that total number of telecom towers would reach ~1,000,000 by FY17 primarily driven by increasing penetration in rural areas. But some of the major obstacles in the industry involve high operating cost and lower availability of continuous electricity in rural and semi urban areas.

Some of the pain points of the sector are:

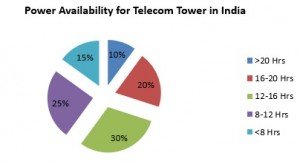

Fuel cost involves major portion of the Operational Expenses: Around 30-34% of telecom tower operational expenditure involves the fuel cost. Due to the risky power scenario ~40% of the telecom towers face load shedding for more than 12 hours per day. 60% of the power requirement for the tower is mostly fulfilled by diesel than Grid.

Use of DG and Diesel Pilferage: Cost of power using DG (including subsidy) is 80-120% more than electricity. Diesel pilferage losses ~20%, also increases the overall energy costs further.

Higher dependency on Diesel and Diesel price Increment: It is estimated that telecom towers alone consume ~2 billion litters of diesel per year. Five years ago, the telecom industry overtook Indian Railways briefly as the country’s largest consumer of diesel, mentioned by the report by the environmental group Greenpeace. Unregulated diesel price is a major headache for the tower operators. The rise in diesel prices, by more than 50% since January 2009, is something towercos can’t afford to ignore.

Higher Carbon emission and Regulatory Guidelines: Towers have a significant carbon footprint. Diesel consumption from telecom towers accounts for ~5.2 million tons of carbon dioxide per year, which is 2% of total green-house gas emissions from India. Questions have been raised by TRAI to control emission. TRAI is also contemplating telecom service providers to aim at Carbon emission reduction targets for the mobile net-work at 8% by the year 2014-2015, 12% by the year 2016-2017 and 17% by the year 2018-2019.

Unpredictable generation of renewable energy for hybrid towers: As a reform many Tower operators started using renewable energy like Solar, Wind and bio fuel for the hybrid tower. Telecom Regulatory Authority of India (TRAI) proposed to power at least 50% of all rural towers and 20% of the urban towers by hybrid power (Renewable Energy Technologies (RET) + Grid power) by 2015 & 75% of rural towers and 33% of urban towers by hybrid power by 2020. But unpredictable generation of renewable energy is not giving enough benefits to the operator.

Considering these factors energy storage integration with the telecom tower is a better prospective for the sustainable future. Energy storage application can provide 20-25% of annual savings in current fuel cost to the operators. Different technologies such as advanced Lead acid, lithium Ion, Zinc bromide can be suitable for this purpose. In some case fly-wheel storage system can also be integrated with large capacity tower.

Why Energy storage application is a better solution to fuel issue of telecom tower?

i. Initial Capital Expenditure –moderate

ii. Operational Expense – Low

iii. Reliability – High

iv. Capacity – High (As per the requirement of the tower)

v. Dependency – Low (Independent to geographic location)

vi. Fuel availability – Can be integrated to Grid and Renewable energy source both

vii. Eco Friendliness – High (Depends upon the technology and higher than the Diesel)

In mid last year, Indus Tower Ltd announced it would be replacing diesel generators with energy storage at 20,000 of its 110,000 towers within next 2 years. The move came after the company stopped using diesel for power back-up in 5,000 towers, saving 3.6 million litres of the fuel a year. India Energy Storage alliance, IESA predicts that, after Reliance-SAFT deal, in near future other telecom tower operators like BSNL, GTL, Viom and Bharati Infratel will join the reform. To support this reform many foreign and Indian battery manufacturers like EXIDE, ABB, GE Energy, High Power batteries are active in the Indian market.

[The article has been written by Debi Prasad Dash. He is presently working as an Analyst in an US based consulting firm, Customized Energy Solutions at Pune. He has good expertise in energy finance and quantitative modelling in energy sector.]