Paytm, the Indian payment player recently unveiled its mini app store to offer Indian consumers an alternative to download mobile apps in their smart phone. The app store has quickly gathered significant traction attracting known brands like Dominos and McDonalds as well as wide scale support from Indian unicorn startups like Zomato. Is this a challenge to the monopoly of Google Playstore?

Google and Paytm have been in a bitter war of words since Sept 2020 when Google temporarily removed the payment app from its Playstore. The controversy revolved around Paytm Cricket League and the payment app rolling out cricket stickers which enabled users to get cashbacks. It is interesting to note that Google through its payment app GooglePay ran “Tez Shots” campaign during IPL where users get coupons and cashbacks by scoring certain number of runs in a cricket game.

Furthermore, Google has also removed Dream11 ( which is the main sponsor of IPL 2020) from its playstore as it allows individuals to participate in fantasy league and win real cash. The reason cited here is that the app as similar to gambling even though fantasy game leagues are not banned in India.

The core issue here is majorly in two aspects:

- Does Google’s policy allow applications which promote any form of fantasy games for cash or gambling? It doesn’t and Google has been quite neutral in adopting a zero tolerance policy in this regard.

- Was removing Paytm justified when its own app (Google Pay) was indulging in the same activity ? The main controversy lies here.

In any market consumer is the king. The consumer gets to decide what it wants to buy. However, what happens if there is only one seller in the market ? In such a monopolistic market, it is the seller who gets to decide what the consumer should be able to buy. The digital world of android mobile apps is similar to such a market where Google gets to decide what it likes. It is the kind of hegemony that any company that owns the operating system will enjoy and is quite contrary to free market economy.

If we consider sheer numbers, Google Playstore has more apps than the other three app stores combined as on Sept 2020 (Graph below, Data source: Statista). This is probably what is fueling this authoritarian attitude when it comes to regulating android applications.

Moreover, the entire incident also reflects the kind of hold that Google enjoys in the digital banking space in India as it can unilaterally remove the most popular payment app from its store at will. Sometime back, even wallet app Mobikwik was removed from the Playstore for promotion of “Arogya Setu” (a government app for tracking covid-19 cases) inside its app.

Paytm has also been quite vocal about this unilateral action from Google and has not minced its words. In its blog , Paytm has referred to the incident as a clear case of conflict of interest for Google as it competes with many businesses with apps of its own. The below excerpt is from the blog Paytm has written:

(This will be familiar to all Indian internet companies since they face similar arm-twisting and fear of Google’s dominance over India’s digital ecosystem every day.) Quick segue to some background — Google owns Android which is the operating system on which over 95% of smartphones in India run. Google, as a result, has enormous control over which apps you download through its Play Store policies.

In many ways, the approach adopted by Paytm is justified here since the campaign “Paytm Cricket League” for which the app was removed was similar to “Tez Shots” campaign run by Google Pay. Furthermore, if we consider the advertising policy of Google, it is ok to promote such a campaign through advertisement on Youtube but not inside the application. Quite an irony right ! So it is clearly a case of revenue loss for Google and not about its policies.

So, this brings us to another major point in this discussion. Should such app stores be controlled by an independent third party or should there be multiple app stores to prevent the dominance of one. The mini app store that Paytm has launched is catering largely to creation of web apps and javascript based apps rather than full fledged android apps. It is indeed a smart move and can help small retailers provide app experience to its customers in terms of shopping. Web apps unlike full fledged apps are basically custom web view version of the websites. So when an update appears, the same will be directly reflected in the app. Moreover, there is no need to go for an approval process for any update. So even though in its newspaper ad, Paytm may claim like taking on Google, in reality it is more of a PR activity targeted at retaining its user base and the retail merchants.

Newspaper Advertisement of Paytm promoting its mini app store

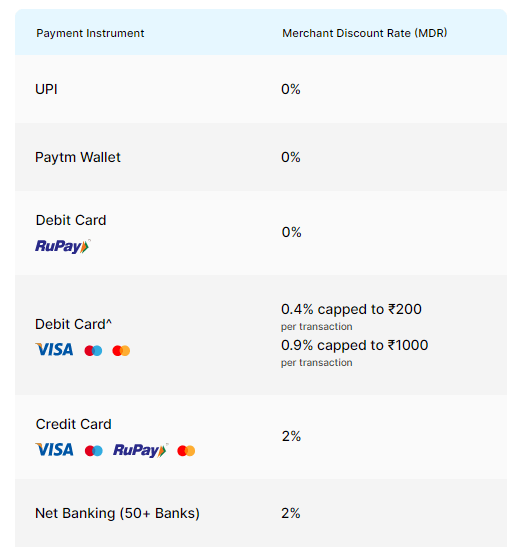

Source: https://business.paytm.com/miniapps

The tarriffs which have been announced for the app store seems targeted at increasing the wallet based transactions with 0% MDR being offered for RuPay cards, UPI as well as Paytm.

There are however two serious contenders in India challenging the Playstore dominance. The first one happens to be chinese phone maker Xiaomi which also promotes users to download apps from its own app store. This is significant considering Xiaomi has the highest market share in India in terms of android handsets sold. The second is more intriguing with the government planning to launch its own app store . With the help of regulations and guidelines, the government can push its app store in every handset operating in the country.

While Google seems to win presently, there are certainly interesting times ahead for its app business in India.

Disclaimer: The views reflected above are personal and does not reflect that of any organization.

Tags: android googlepay payment paytm tez XiaomiYou might like reading:

What makes a good start-up strategy?

Or 5 things to keep in mind while devising a start-up strategy Let’s face it, start-ups are all over the shop. Some of them just work, and are hailed as the next big thing since the invention of Pizza (Cheese-Burst or otherwise) but a large majority fail and disappear without as much as a whimper. While it is difficult to […]

Got Punk’d: Marketing moves that backfired

Social media marketing is slowly gaining importance because of its cheap and and effective communication with the customer.In fact the best brands in the world have already marked their presence in Facebook, Twitter and other social networking sites. But one needs to be cautious because the same customers who praised you, may also get against you. Below are few examples […]