Real estate industry in India plays a crucial role in the overall development of India’s infrastructure. The real estate industry is highly cyclical in nature and price movements in the real estate market causes fluctuations in the property market. This is due to the changes in the economic, demographic and policy changes in the economy. The real estate industry’s growth is linked to the development in retail, hospitality and entertainment (hotels, theatres etc), economic services (schools and hospitals) etc. Real estate contributes about 5% to India’s GDP and total revenue generated from this sector stood at USD 66.8 billion in FY11.

Segments in the Indian Real Estate

Residential Space

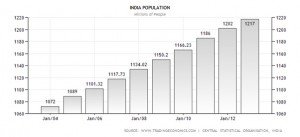

Residential growth in the real estate sector has been huge. There have been a number of reasons for the same. Indian population has been growing at a tremendous rate. The below graph shows the rise in Indian population ( year 2004 to 2012). And it is expected that the population will cross 1470 million by 2030.

The demand for houses has increased considerably and so have prices because of the demand supply gap.

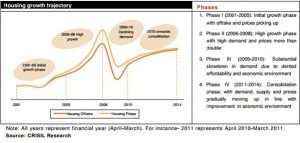

The growth phases in the residential real estate industry can be seen in the chart below:

Even with quite a boost in the sector, there is still a gap in demand and supply. The housing shortage in urban India stood at 20.5 million in 2010 and that in rural India was 26 million. The current residential space scenario depicts huge opportunities. There are many small players and only a few large ones like DLF Unitech etc.

With growth in population, the demand for real estate is expected to increase. Urbanisation, increasing income, easy availability of finance and growth of nuclear families are other factors that will drive demand for residential real estate, further.

Commercial Space

The office space in India has also shown a growing trend in the last few years. The growth has been usually due to the services sector and IT sector. IT companies have huge requirement for space because of the large employee size and their ever growing business needs. Tax benefits have also led to the growth and development of IT parks and SEZs.

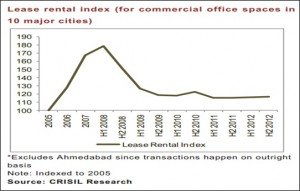

During the recession period, the commercial space demand decreased drastically which led to excessive supply of office space. This demand supply gap has led to many vacant office spaces. This also led to a fall in the rentals by almost 25-30%. Although the economy has picked up slightly, the rental rates have not fallen further but neither has it led to the appreciation of the rents. Because of the lesser amount of office spaces are being rented out; the operating trend for the trend is moving from buying the property to leasing out the space.

Retail Space

The retail industry had been growing at a very fast pace before the 2008 recession, post which the growth is not that high. The key drivers for the growth of this sector have been mainly lavish lifestyles, high disposable income and tendency to spend. Because of this growth in the industry, the real estate industry recorded an increased demand. This demand has been mainly in the Tier II and Tier III cities where the penetration of the retail industry has growth dramatically.

A numerous malls have come up in the various cities. The footfalls in the malls had increased immensely till 2008 post which foot falls have reduced due to which profits have reduced. This sudden change forced developers to delay newer projects. Many new project launches are postponed due to the weak market.

Going forward it is expected that with the revival of the economy the growth in this sector would boom again. Also, with various MNC retailers entering the Indian market along with the increased FDI limit for multi-brand retail, it is forecasted that the demand will rise significantly.

Hospitality Space

Increased domestic, business and leisure travel has led to the increase in hospitality real estate demand. The hospitality market comprises of not only hotels but service apartments and convention centres too. And, service apartments are particularly attractive in this industry. Rising incomes, packaged tours, easily available travel guides and lavish lifestyles are the key drivers that have promoted this segment of the industry.

Prior to 2008, ARR (Average room rate) and OR (Occupancy Rate) were higher post which hotel industry faced a fall in demand which negatively impacted the industry revenues.

Real Estate Sector Indicators

-Deposit to Income Ratio: The deposit to income ratio is the minimum required down payment for a typical mortgage, expressed in months or years of income.

-Affordability Index: Actual Monthly cost of mortgage/ Take home income: An index value of 100 means the maximum affordable mortgage for a family with the median income is large enough to purchase a home at the current median price. With increased affordability, prices of realty stocks tend to increase.

-Debt Service Ratio Or Housing Debt to Income Ratio:Receiving a ratio of less than 40% means that the potential borrower has an acceptable level of debt.

-Housing Debt to Equity Ratio: Percentage of your income would go toward your housing expenses, including your monthly mortgage payment, real estate taxes, homeowner’s insurance and association dues. Higher ratios tend to increase the likelihood of default on the mortgage.

-Valuation of Land held: As the land value increases, it tends to push stock prices up.

-Ownership Ratio: The ownership ratio is the proportion of households who own their homes as opposed to renting. A high ownership ratio combined with an increased rate of subprime lending may signal higher debt levels associated with bubbles.

-P/E Ratio = House price / (Rent – expenses):The price-to-earnings ratio or P/E ratio is the common metric used to assess the relative valuation of equities.

-Price – Rent Ratio = House Price/ Annual rent: It can be viewed as the real estate equivalent of stocks’ price-earnings ratio.

Indian Government Policies in Real Estate Sector

Ease in Housing Loan finance: Government of India has relaxed the housing loan limits. Earlier, banks were allowed to give out loans upto 10% of their total assets. This limit has been increased by 5% for granting loans to individuals’ upto 25 lakhs limit which would be covered under priority sector lending.

FDI in real estate: At present 100% FDI in real estate sector is allowed through automatic route subject to minimum criteria. For housing plots, the project must have at least 10 hectares. Group-housing projects (apartments) are eligible for FDI if the total built-up area is at least 50,000 square metres. The ministry is considering recommending some relief in three areas: one, minimum built-up area requirement should be reduced, two, the definition of the minimum lock-in period should be changed and, third, the minimum capitalisation -(investment) that is required should be reduced. These changes will bring in more players in the market.

Proposed Real Estate Bill: When the Real Estate (Regulation and Development) Bill 2013 comes into effect, all projects will have to be registered with a real estate regulatory authority. Promoters will have to disclose details about the project. All brokers and agents will have to be registered with the regulator before they can practise. Builder will have to provide a list of agents who will represent each project.

Once the project is registered, all details will have to be put on the website and updated every quarter. This includes disclosing the extent of project completion. This will not only eliminate middlemen but also help buyers make informed decisions.

Way Forward

India’s real estate sector is estimated to have a total supply pipeline of close to 3.6 billion sq ft lined up for completion in the year 2013, with about 98% of this being concentrated in the residential, said a report prepared by CBRE titled “Assessing the Economic Impact of India’s Real Estate Sector”.

Potential for growth in this sector is tremendous. It will generate employment and will contribute to the GDP of the economy. The total contribution of the real estate sector to the national GDP has been estimated to be about 6.3% in 2013.This industry, however, requires government support through policies because of the numerous challenges like high borrowing costs, high gestation periods and long approval lead time.