FMCG OVERVIEW

-Fast Moving Consumer Goods (FMCG) goods, popularly named as consumer packaged goods, play a vital role as a necessity and as an inelastic product. Rural India accounts for 70% of India’s population, 56% of National Income, 64% of total expenditure and one third of the total savings. The Indian FMCG sector is the fourth largest sector the economy with a total market size of Rs. 167,100crs.

-The market is estimated to grow to US$ 100 billion by 2025, according to market research firm Nielsen. In the last decade the FMCG sector has grown at an average of 11% a year; in the last five years, annual growth accelerated to 17%. The FMCG Industry is characterized by a well-established distribution network, low penetration levels, low operating cost, lower per capita consumption and intense competition between the organized and unorganized segments.

-FMCGs are slowly and gradually positioning and deeply penetrating in the fast growing rural market.The FMCG sector in India continues on a strong growth path with both Urban and Rural India contributing to its growth. Rural India contributes one third of FMCG sales in India.

-Growth driven by increasing consumption led by rise in incomes, changing lifestyles and favourable demographics

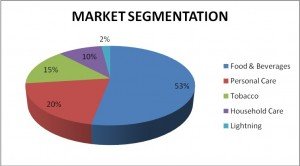

The following chart shows the composition of FMCG sector across India, with the break-up of contribution by different categories:

GROWTH PROSPECTS OF FMCG IN RURAL INDIA

-With the presence of 12.2% of the world population in the villages of India, the Indian rural FMCG market is something no one can overlook.

-Increased focus on farm sector will boost rural incomes, hence providing better growth prospects to the FMCG companies. Better infrastructure facilities will improve their supply chain.

-The Accenture report goes on to state that rural incomes have been growing at more than 7% over the past few years, helping to account for almost 40% of India’s total consumption of goods and services.

-FMCG sector is also likely to benefit from growing demand in the market. Because of the low per capita consumption for almost all the products in the country, FMCG companies have immense possibilities for growth. And if the companies are able to change the mind-set of the consumers, i.e. if they are able to take the consumers to branded products and offer new generation products, they would be able to generate higher growth in the near future.

-It is expected that the rural income will rise in future, boosting purchasing power in the countryside. However, the demand in urban areas would be the key growth driver over the long term. Also, increase in the urban population, along with increase in income levels and the availability of new categories, would help the urban areas maintain their position in terms of consumption.

-At present, urban India accounts for 66% of total FMCG consumption, with rural India accounting for the remaining 34%. However, rural India accounts for more than 40% consumption in major FMCG categories such as personal care, fabric care, and hot beverages.

-In urban areas, home and personal care category, including skin care, household care and feminine hygiene, will keep growing at relatively attractive rates. Within the foods segment, it is estimated that processed foods, bakery, and dairy are long-term growth categories in both rural and urban areas.

IMPACT OF FMCG SECTOR IN INDIA:

Employment

-Direct employment is estimated at approximately 6% of turnover, i.e. US$ 1.5 billion4 (Rs. 7,000 crores)

-Approximately 12-13 million retail stores in India, out of which 9 million are FMCG kirana stores. Thus the sector is responsible for the livelihood of almost 13 million people

Fiscal Contribution

-Cascading Multiple Taxes by the FMCG sector(Import duty, service tax, CST, income tax). 30% revenue of the sector goes into both direct and indirect taxes. estimated size of $25 billion (Rs. 120,000 crores), that would constitute a contribution to the exchequer of approximately US$ 6.5 billion (Rs. 31,000 crores).

Social Contribution

-Create employment for people with lower educational qualifications. FMCG firms have also undertaken some specific projects to integrate with upcountry and rural areas for both inputs and for distribution as well as to fulfil CSR.

SOME EXAMPLES:

ITC Echoupal And Choupal Sagar:- sells both agricultural inputs and daily needs products. ITC’s rural e-network enables farmer connectivity and provides an easy way for farmers to get better profitability and control through access to timely information.

HUL’s Shakti Amma Network:- HUL pioneered a rural entrepreneurship model amongst women who became HUL distributors.

Dabur India:- regularly conducts rural and adult education programs and provides training in rural areas to facilitate employability.

Contribution to Other Sectors

Agriculture – Its intake of agricultural output as raw material is estimated to constitute roughly 9% of total turnover for the sector. That would put its total value to agriculture at US$ 2.2 billion7 (Rs. 10,500crores).

Third Party Logistics – The third-party logistics market for the FMCG sector in India has been growing at a CAGR of 12% since 2002, and is estimated to be worth US$ 63 million8 (Rs. 300 crores). It is anticipated to double by 2011, and be worth over US$ 146 million (Rs. 700 crores) by 2012, a growth of 211% from 2002.

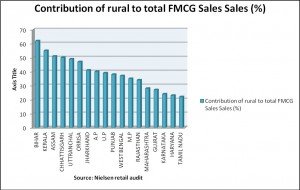

We clearly identify that Bihar is the leader in the rural contribution to total FMCG sales, and Tamil Nadu is the state with the lowest rural contribution. The following graph throws some light on the growth of the FMCG retail sector, both, in terms of rural and urban.

Ancillary Industries:-

Manufacturing – Almost 9-10% of total sector’s production is outsourced to contract manufacturing units taking the total size to $ 1.7 – 2 billion (Rs. 8,000 – Rs. 9,500 crores), approximately.

Distribution –ITC services 1.1 million outlets at an average frequency of three days down to villages with population of 2,000, and has 1,000 wholesale dealers. Marico reaches 1.6 mln outlets, through almost 900 direct distributors, 100+ super distributors, catering to almost 2,500 small stockists and 4,600 van markets.

Packaging Industry – The packaging industry for the FMCG sector alone is worth US$ 2.9 billion10 (Rs. 14,000 crores), and is expected to grow faster due to the growth of private label FMCG products.

Media Industry – The media industry has a lot to gain from the FMCG sector. Around 40% of media industry earnings from advertising (US$ 5 billion) are estimated to come from the FMCG sector, a contribution of US$ 2 billion (Rs. 9,500 crores).

FMCG SECTOR PERFORMANCE, COMPANY WISE:

|

BCG ANALYSIS

|

|

STATUS

|

COMPANIES

|

|

HUL

|

ITC

|

NESTLE

|

DABUR

|

P&G

|

|

Cash-Cow

|

AXE, Vaseline, Petroleum Jelly

|

Cigarettes

|

Cerelac

|

Chayawanprash, Vatika Amla, Hajmola

|

Ariel, Vicks, Tide

|

|

Star

|

Lux, Sun-Silk, Fair& Lovely, Ponds, Kissan Ketchup, Surf-Excel, Annapurna Atta

|

Paperbroards/ Packaging, Agri-Business

|

Nescafe, Maggii Noodles

|

Real Fruit Juice, Active Fruit Juice, Dabur Red Toothpaste

|

Gillette, Pantene, Head & Shoulders, Pamper, Whisper

|

|

Question

|

Rin, Pepsodent, Domex

|

Automotive, Furniture, Financial, Tobacco, Food

|

Milo, Kitkat/ Munch, Maggi Soup, Nestle Butter, Nesvita, Nestle Maggi

|

Odomos, Sanifresh, Oxylife Facial

|

Olay

|

|

Dog

|

Wheel

|

ITC Infotech

|

Nestea, Milkybar

|

Dabur Gulabari, Burst Fruit Juice

|

|

The following chart shows the top-10 contributing categories to rural markets:

|

TOP 10 Rural Categories

|

|

Category

|

Rural Contribution to category sales- FY2010-11

|

Value Sales Growth % vs. year ago FY 2010-11

|

|

|

UR Growth %

|

Urban

|

Rural

|

|

Biscuits

|

41%

|

23.90%

|

23.20%

|

24.90%

|

|

Refined Edible Oil

|

18%

|

27.60%

|

25%

|

41.10%

|

|

Salty Snacks

|

23%

|

42%

|

37.80%

|

58.30%

|

|

Non-Refined Oils

|

30%

|

27.10%

|

23.60%

|

36.50%

|

|

Toilet Soaps

|

43%

|

11.40%

|

12.10%

|

10.50%

|

|

Washing Powders

|

46%

|

10.60%

|

10.80%

|

10.40%

|

|

Packages Tea

|

44%

|

14.40%

|

17.30%

|

10.90%

|

|

Iodised Salt

|

59%

|

16%

|

11.30%

|

19.60%

|

|

Hair Oil

|

37%

|

19.40%

|

18.10%

|

21.70%

|

|

Shampoos

|

35%

|

20.80%

|

19.50%

|

23.30%

|

|

Source: Nielsen (http://in.nielsen.com/news/20110711.shtml; accessed on 24 September 2011)

|

The following chart tells us about the market leaders present in various categories, primarily in rural India.

SOURCE: Ernst & Young, competing for market share in Rural India

|

COMPANY PRESENCE IN RURAL MARKETS

|

|

COMPANY

|

CATEGORY

|

% SALES FROM RURAL MARKETS

|

|

HINDUSTAN UNILEVER

|

HOUSEHOLD PRODUCTS

|

45

|

|

HERO HONDA

|

TWO-WHEELERS

|

60

|

|

DABUR

|

PERSONAL PRODUCTS

|

40

|

|

DISH TV

|

MEDIA

|

33

|

|

TVS

|

TWO-WHEELERS

|

50

|

Next, we look at the state wise break-up of the contribution of various states to the total FMCG sales:

We clearly identify that Bihar is the leader in the rural contribution to total FMCG sales, and Tamil Nadu is the state with the lowest rural contribution. The following graph throws some light on the growth of the FMCG retail sector, both, in terms of rural and urban.

RURAL MARKETING BY FMCG SECTOR

With the urban market saturated, FMCG companies are now targeting the rural markets. In spite of the income imbalance between urban and rural India, rural holds great potential since 70% of India’s population lives there. Due to the recent government measures like waiver of loans, national rural employment guarantee scheme and increasing minimum support price, disposable income in rural India has been rapidly increasing.

However, rural markets present their own sets of problems. These include poor infrastructure, dispersed settlements, lack of education and a virtually non-existent medium for communication. Furthermore, retailers cannot be present in all the centres as many of them are so small that it makes them economically unfeasible.

Hindustan Unilever Limited (HUL) – Shakti

Hindustan Unilever Limited (HUL) to tap this market conceived of Project Shakti. This project was started in 2001 with the aim of increasing the company’s rural distribution reach as well as providing rural women with income-generating opportunities. This is a case where the social goals are helping achieve business goals.

The recruitment of a Shakti Entrepreneur or Shakti Amma (SA) begins with the executives of HUL identifying the uncovered village. The representative of the company meets the panchayat and the village head and identify the woman who they believe will be suitable as a SA. After training she is asked to put up Rs 20,000 as investment which is used to buy products for selling. The products are then sold door-to-door or through petty shops at home.

On an average a Shakti Amma makes a 10% margin on the products she sells.

An initiative which helps support Project Shakti is the Shakti Vani program. Under this program, trained communicators visit schools and village congregations to drive messages on sanitation, good hygiene practices and women empowerment. This serves as a rural communication vehicle and helps the SA in their sales.

The main advantage of the Shakti program for HUL is having more feet on the ground.

Shakti Ammas are able to reach far flung areas, which were economically unviable for the company to tap on its own, besides being a brand ambassador for the company. Moreover, the company has ready consumers in the SAs who become users of the products besides selling them.

ITC E-Choupal:

Launched in June 2000, ‘e-Choupal’, has already become the largest initiative among all Internet-based interventions in rural India. As India’s ‘kissan’ Company, ITC has taken care to involve farmers in the designing and management of the entire ‘e-Choupal’ initiative. The active participation of farmers in this rural initiative has created a sense of ownership in the project among the farmers. They see the ‘e-Choupal’ as the new age cooperative for all practical purposes.

The e-Choupal model has been specifically designed to tackle the challenges posed by the unique features of Indian agriculture, characterized by fragmented farms, weak infrastructure and the involvement of numerous intermediaries, among others.

Appreciating the imperative of intermediaries in the Indian context, ‘e-Choupal’ leverages Information Technology to virtually cluster all the value chain participants, delivering the same benefits as vertical integration does in mature agricultural economies like the USA.

‘E-Choupal’ makes use of the physical transmission capabilities of current intermediaries – aggregation, logistics, counter-party risk and bridge financing, while dis-intermediating them from the chain of information flow and market signals.

INSIGHT:

-From all the above information’s it is clear that the rural India can be one of the most feasible market for the development of the FMCG in INDIA as 70% of the total population resides there.

-Rural market is still an untapped market potential for major players including MNC’s who can operate on low margin but at large volumes. Such companies which can sustain with delayed breakeven on longer run.

-FMCG’s companies or marketers make consistent attempts to innovate tools and strategies to overcome the challenges the face in the business area.

-Infrastructural development is a major requirement for rural market as still 37% (population less than 500) of the village are still not connected by roads.

-Corporate India and government bodies alike have made several efforts to bridge the gap between rural and urban India. “Indira Awas Yojna”, “Rajiv Gandhi Grameen Vidyutikaran Yojna”, “The Mahatma Gandhi National Rural Employement Guarantee Act”, The Swarnjayanti Gram Swarozgar Yojna”, “Pradhan Mantri Rojgar Yojna”, etc are some of the initiatives by the government.

-Companies like Yamaha, Dabur, etc have different marketing strategies and marketing budget allocation for rural areas. This helps them to target the consumer base that gets easily influenced by such strategies.

Thus if planned properly and with the use of new strategies and technologies the rural India market can be captured and a great margin of profit can be earned by the FMCG companies.

[The article has been written by Priya Dubey & Abhishek Sharma. They are presently pursuing their MBA from DSIMS, Mumbai.]