1st August, 2012 began as just another day on the Wall Street. But it soon turned into a bloodbath for some stocks – among them were P&G, Good Year Tire and Rubber and Trinity Industries. These listed stocks of the NYSE saw a massive surge in their transacted volumes and violent swings in the first hour of trading – Goodyear jumped almost 10% from $11.51 open to $12.60, before correcting to $11.60.

Closer home, on 5th October happened an incident which spooked the markets of one of the world’s most resilient and fastest growing economies. The NSE Flash Crash saw the 50 share Nifty index plummet by over 15% in a matter of mere 15 minutes – leading to temporary suspension in trading in the National Stock Exchange. Seen from the right perspective – the incident only shows how hollow our systemic reforms over the past few years have been.

These two incidents show the devastating power of modern trading platforms. While the damage was contained immediately in both the cases, the flaws exposed in the system indicated that the markets still have a long way to go in understanding the technology.

Here the causes mentioned for these crashes are just the tip of iceberg; these reasons include human errors, technical errors, market manipulation, technical glitches in electronic trading software, logical error in algorithms, and disturbances in latency of information flow. This article intends to describe how small errors can jeopardize the market confidence which is very fragile and subsequently have enormous negative economic impacts.

What exactly is High Frequency Trading?

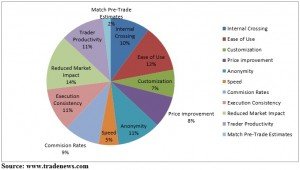

HFT is the use of advanced technological and algorithmic systems to automatically trade stocks and options on the stock market at rapid speed – literally, the speed of light. Today, up to 75% of all trading on Wall Street is attributed to these trading platforms. More and more investment firms and banks now have started using these platforms to carry out their trades. This addiction to technology is only going to get stronger in the coming years. Graph below shows the reasons and advantages of using algorithmic trading.

The rapid increase in use of this technology in the field of finance can be understood if one sees its rise in the backdrop of evolution in computing speed. The rapidity at which trades are executed is phenomenal – and has contributed to increased liquidity of stocks in the financial markets. The touted advantages include lower degrees of human intervention, reduction of risks, increased liquidity, faster processing of information and greater efficiency in trading.

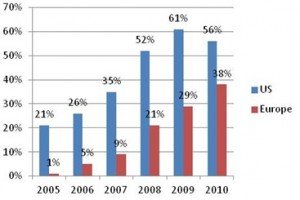

|

| High Frequency Trade as % Equity Turnover by Volume |

What makes these trading platforms score over traditional platforms is their speed to obtain and process real-time quotes, keep track of the positions and ensure that the various constraints in terms of risk profile of investors and ensuring that the trading costs are within the acceptable ranges. Algorthmic trading may involve sophisticated use of artificial intelligence to churn out constantly generated real time news from various sources to generate new buy/sell signals which can be used to simplify stock picking mechanism but it has its own trade-offs which may pose significant risks to positions held by a trader.

Humans are by no means perfect. History is replete with instances where humans have succumbed to the temptation of greed. Decreased human intervention and automated informational processing have blunted the irrational aspects of trading. Now, trades are placed with a greater logical precision and behavioral biases like overconfidence, herd behavior have been considerably controlled.

The Side Effects of HFT Technology

The development in technology has also spawned to electronic trading systems where the major portion of trades is executed electronically. Trading decisions are taken based on patterns hidden in historical data which do not include behavioral variables which are difficult to quantify. Complex algorithms are the backbone of high frequency systems and these algorithms may price the stocks rationally but this high surge in algorithmic trading presents significant risks where algorithms may go haywire. Algorithmic trading is no doubt profitable but sometimes can result in unwanted catastrophes, in fact it had.

Recent events have shown that the positives of High Frequency Trading are possibly outweighed by the dramatic negative effects. As an analogy – consider trading to be a game of Russian roulette, where the payoffs on winning are great – but the payoff on losing is devastating.

What is a Flash Crash?

A Flash Crash is a sudden dramatic decline of stock prices across significant cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are generally driven by panic & other underlying economic or speculative factors. However, of late there have been instances where the systems have themselves contributed to these crashes – resulting in extensive loss of paper wealth to the investors. Developments like the introduction of Algorithmic Trading and their linkages with High Frequency Trading (HFT) Systems have contributed to these systemic flaws.

Most important crashes in 2012

In year 2012, India and United States witnessed two flash crashes respectively called as Nifty Crash and Knight Capital mini crash. Even though these were small crashes as compared to the biggest crash of 6 May, 2010 which wiped out approximately 1 Trillion dollars (approximately 9 % of entire market) of investor’s money; they were significant enough to kill the market for years if the restoration and correction in indexes had not happened. Following figure mentions various crashes occurred at different markets of the world in last 2 years.

Nifty Flash Crash: Analysis

The flash crash that we saw in Nifty was because of an erroneous trade entered by a trader at his terminal. While executing a transaction in the Nifty cash basket, a trader mistakenly punched in orders for sale of 34 lakh Nifty cash baskets comprising of stocks in the Nifty-50 instead of selling NSE basket worth Rs. 34 Lakhs. This led to a massive sell-off and subsequent crash in the Nifty. According to a SEBI report, the reason may be attributed to the time lag between order execution and index value revision. At NSE this time lag corresponds to when the trades are executed in milliseconds and the index is updated every three seconds .Even though NSE has triggers but when index went down by 10% , execution of series of buy/sell orders between two index updates may have caused index to fall sharply. So as soon as the nifty triggers activated when it fell for 10%, new orders were rejected by the execution queue but in order to maintain the consistency of the system, orders which entered into the system between two consecutive updates need to be executed.

Knight Capital Flash Crash: Analysis

The problem is worsened by the game of one-upmanship played between the brokers and the exchanges – resulting in losses to the investor. As more and more trades get settled outside the networks of the exchanges – owing to the development of complex platforms by the brokers, the power of the exchanges to monitor the trades is reduced considerably.

In the curious case of DJIA Flash Crash, the day of the crash coincided with NYSE’s launch of its own trading platform, called “Retail Liquidity Program”, which they hoped would help them reclaim some part of the trades from the market makers. The logic was that RLP would foster greater competition among traders to the extent that more orders would get filled at better prices on the exchange. Post crash, Knight Capital said that the technical glitch that caused the crash had to do with NYSE’s new trading system. Interestingly, the stocks that Knight’s computers messed up were all listed on the NYSE. While it can be assumed that Knight tried to upgrade its own systems to exploit loopholes in NYSE’s new system. The gamble did not pay off for them. Instead, when other traders saw the spike in activity, they jumped in too – setting off a domino effect. Though the faulty algorithms were disabled within 15 minutes, the damage was done. The trading frenzy that followed shows that there is immense power in the hands of the traders – which is used extensively and seldom understood. While Knight lost out $440 million, and the investor-confidence was beaten once again.

Real issue is when this was happening to knight Capital, was it possible for their traders to intervene manually and stop the erroneous trades. Even though manually this intervention was made and the faulty algorithms were disabled within 15 minutes, the damage was already done .This lead to a scenario where the loss earned by the Knight Capital were four times more than their income and they had to consider options for Chapter 11 Bankruptcy.

What causes a Flash Crash?

Even assuming that the cause is blamed on human error in case of Nifty crash in India, the lack of safeguards in the systems to prevent such massive sell-offs mean that the error was probably exacerbated by high-frequency trading, which involves using software to post orders for microseconds at a time to exploit even miniscule differences in share prices. Apart from manual and technical errors, we will try to throw some light on some of the major possible causes of flash crashes.

Major components of global financial system are driven by fast electronic machines which in integrated sense make a very complex computer network infrastructure. Even an error of minute scale whether it is technical, logical, algorithmic, time lag (difference between timing of information passage between two points or small variation in timing of information consumption between two components) or human error, it is sufficient to bring down an entire economy to its knees in few seconds. This paper describes few risks which may lead to a probable flash crash.

(a) Credit risk

Most important issue for electronic markets is Credit risk. Bulge bracket firms make trades such that their average daily trading volume may amount to a large multiple of their capital. Even though these firms may avoid taking big risk, small malfunctioning in trading system or an algorithmic error may lead to rapid accumulation of risky positions. Even though the transactional speed advantage gained by HFT may bring huge profit to them but unanticipated technical issues may pose a danger of rapid and enormous risk accumulation.

(b) Illegitimate information attack in a legitimate way

Some electronic trading firms may use their technological infrastructure to exploit discrepancy in order execution system of exchanges where they overload the exchange with trade messages. This enables them to use their technological competitiveness to place themselves before any other order, which forces market participants to withdraw their orders. A variant of this technique is stub-quotes, where a trading firm is not willing to trade with real money at certain prices and it tries to offer quotes which are at extreme such as buying a stock at $1 or selling a stock at $99,999.9. The intention behind doing this is when a firm acting as a market maker tries just to fulfill its compliance requirements due to the lack of liquidity and offer quotes which are hard to execute. Probably this must have happened on 6th May 2010 where the prices went down for various stocks.

Prevention through monitoring and regulation

In India, SEBI has taken a very conservative position on Algotrading. It has stipulated that the stock exchanges ensure all their algorithmic orders get routed through broker servers located in India and asked the stock exchanges to develop appropriate mechanisms to counter risk by adopting risk controls like Price Check, Cap on Order Size, Price Band Filters and Quantity Limit Check. After this Oct 5 flash crash India will have new procedures to stress test its trading infrastructure to avoid these kinds of incidents again. Robustness of the system needs to be examined at regular intervals.

In US, the SEC has also taken steps to ensure that greater monitoring of such rogue trades occur. SEC has formulated new rules aimed at provided clarity about when trades are cancelled. Now, Financial Industry Regulatory Authority (FINRA) will break trades that are at least 30% away from a predetermined “Reference Price”. In cases where more than 20 stocks are involved it has been defined by the SEC as typically the last sale price before pricing was disrupted.

Conclusion

Algorithmic trading is really profitable, it can provide us high liquidity and it can be a cure to human corrupt nature in terms of investing decision if we rely completely on these technologies, but are they really reliable or trustworthy? Recent crash incidents say NO!! . High frequency trading and algorithmic trading is a new field and developing fast with innovations taking place every day, it just started with simple securities like equities and extended to derivatives and foreign exchange markets, but its impacts are still unclear. High Frequency trading involves a high volume of trades with very low average profit per trade in a transaction. But unlike the traditional investment strategy, it does not keep the stock for a long time rather huge volume of trades are compounded to generate a significant profit. The public policy makers need to be more involved with billions of transactions taking place for auditing and monitoring the electronic trade markets which run under threat of possible market crashes caused by automated trading algorithms and various sorts of technical glitches. For all the sounds that we may make, we have to wake up to the truth that Algorithmic trading is here to stay with all its flaws and strengths. Joseph Saluzzi, Co-Founder of US agency broker “Themis Trading”, hit the nail on the head when he said:

“We look at it as minor earthquakes and what they build up to is one much bigger earthquake, which could be an entire global market breakdown.”

For all the brouhaha over the advantages that these HFT Platforms have provided, 2012 has in a way been a watershed year – for it has shown the flaws in the blind race of adopting technology. The argument offered by the brokerages and trading houses that automated smart trading helps in “Price Improvements” ring hollow – they are in terms of only fractions of a fraction of a penny. In return for these marginal improvements we get markets that are getting exponentially unstable.