Executive Summary

As the union-budget is impending, expectations from the budget have now sky rocketed. People are hoping for big bang reforms from this budget showing pro-business attitude of Modi government. Some of the key areas for this budget will be Fiscal Deficit; Goods and Service Tax (GST), subsidy allocation and reallocation, new tax regulations, custom and excise duty changes.

The Modi Government has been engaged more on revenue spending instead of capital spending. In this budget, the government is expected to focus on capital spending because of new initiatives like Make in India, Digital India and the hefty budget allocation to it.

Government is expected to adopt tight measures and keep fiscal deficit at the targeted 3.6% of GDP. This can lead to many disinvestments. Government has been trying hard to meet this year’s fiscal target of 4.1% of GDP. Arun Jaitley, the Indian Finance Minister has also indicated rationalization of subsidies. Besides, railway and defense are expected to get a bigger pie from this budget. Another game changer move would be rolling out the implementation plan of GST, which is to be introduced by March 2016.

Eager to know more? Let’s read ahead…

What we can expect: Is this the dream budget?

Many people are eyeing forthcoming budget in February as a real game changer. The same hype was created during Vajpayee government when Yashwant Sinha was the finance minister. But the budget wasn’t able to meet the expectations. India has experienced GDP growth rate of 5.7% and 5.3% in the first and second quarter of fiscal year 2014-15 respectively, which was above the estimated values. The Index of Industrial Production-IIP for the month of November stood at 3.8% against October’s -4.2% and for December CPI and WPI were 5% and 0.11%, below the forecasted figures. These all data and its trend show promising signs for Indian economy in coming year. RBI’s cut in its interest rate by 25 basis points on 15th January suggests harmony between RBI and government’s growth oriented approach. Analysts are expecting further rate cuts in coming months followed by union budget.

Here are some key points for the coming budget which are the areas to watch out for:

Fiscal Deficit target:

For the year 2014-15, Finance Minister has suggested the fiscal deficit target of 4.1% of GDP and 99% of the target deficit was already met in November 2014 only. It has shackled the government’s hand for its growth initiatives and constrained it to take conservative measures. Government is planning to disinvest public sectors like ONGC, SAIL, and many more based on market conditions. Recent disinvestment of 10% stake in Coal India fetched government around Rs. 22500 Cr. Government is also engaged in spectrum and coal block auctions to generate revenue stream in order to meet the tight fiscal target.

Finance Minister Jaitley has suggested that fiscal deficit target for the year 2015-16 should be 3.6% of GDP. Government has to take some fiscal consolidation steps to meet the estimate in next fiscal and is expected to raise capital by further disinvestment. RBI’s future monetary stance is also dependent on the government’s measures on fiscal consolidation in the forthcoming budget. RBI has kept the interest rate unchanged in latest monetary policy as a safeguard before the budget announcement. For the higher growth, government has to slack its fiscal target and adopt Keynesian policy. 3.6% of GDP would be a tight measure and difficult to achieve. Exercising the previous target of 4.1% would be advisable. Government has been involved more on revenue expenditure instead of capital expenditure. Government should undertake the disinvestment and privatization to sell current Non Performing Assets (NPAs) of public sectors to meet fiscal target.

Custom and excise duty:

Government should impose customs duty on crude oil as we are going through a major fall in the global crude prices. It can help government to meet the tight deficit target of 3.6% and can fetch Rs 14,000 Cr. We won’t see any major change in excise duty as government has already imposed it on fuel as a result of global price fall. In a way, government hasn’t allowed the benefits of reduced price to pass on to the end users. Customs on mobiles and laptops currently stand at 6% and should be raised to 8-9% in order to boost domestic production and contract the imports. High VAT and excise duty are reasons for high import of such goods. Moreover new government had extended the deadline of excise duty cut for automobiles till 31st December during its first budget session but from January, it has been raised to the initial level. Automotive Component Manufacturers Association (ACMA) has sought for excise duty cut as per the previous budget. To promote the Auto sector, this move is likely to be considered. Besides, there have been requests from commerce department to reduce custom duty on gold and silver from 10% to 2%. It will be a judicious move as demand for gold will be elastic in short run and inelastic in long run and increased custom duty can also stimulate the smuggling of gold, though it’s intermediate impact on current account deficit could be disastrous.

Allocation for initiatives:

Hefty fund allocation to the government’s new initiative “Make in India” is expected. In last budget, Finance Ministry had given Rs. 7060Cr for the development of 100 smart cities. Delhi Mumbai Industrial Corridor (DMIC) should get huge budget for infrastructure and smart cities’ development. Government has to increase the budget allocation to increase the rate of development and meet the deadlines for projects.

Rs.2037 Crores was given last year for Integrated Ganga Conversion Mission “Namami Gange”. “Digital India” campaign can also see further increase in funding in comparison to 500Cr in the previous budget.

Taxation Policy:

Government had raised the tax exemption slab to 2.5L in the last budget session. It is advisable to keep tax slabs unchanged for the next fiscal. However as Indian economy is facing demand problem, increase in tax exemption to 3L can help to tackle the sluggish demand. Government can introduce the 10% surcharge in addition to 30% direct tax on superrich whose income is above 1Cr. But it can demotivate the investor and work adversely for the new government’s vision to make India manufacturing hub. Certain tax exemption and tax holiday can be seen for the micro, small and medium enterprises. Various Trade unions have asked to increase income tax exemption to 5 lakhs for the salaried class. They have also opposed ordinance route taken by the government on coal sector, insurance sector and land acquisition act. Government should remove or at least assure on the retrospective taxes. It plays a vital role on global perspective and confidence of investors towards India. Taxation is a primary source of income or revenue receipt for government, which makes it difficult to increase the tax exemption limits.

Goods and Service Tax (GST):

GST will encompass excise duty and service tax of central government and VAT, entry tax or octroi of state government. As per the S&P’s suggestion, India should adopt GST. Most of the states have agreed to GST as government has promised to reimburse the revenue loss of states due to implementation of GST for three years. GST will give input tax credits, which means one can utilize tax paid on purchased raw material or input. It is going provide uniformity in taxation across the states, which will give relief from current cumbersome taxation process. GST will help logistics business primarily and hence ecommerce. In turn, it will aid to sustain exponential growth of electronic delivery of services. But still who should get revenue benefits – supplier or consumer, is still a dilemma. Inclusion of petro sectors under GST is still dubious. Finance ministry is optimistic that GST can help in raising India’s GDP by two percentage points. To keep its promise of introducing GST by March 2016, government should launch clear implementation and inclusion plan of GST in the coming budget.

Subsidies:

Rationalization of subsidies will be a big thing in the watch list. Former RBI governor Bimal Jalan has given Finance Ministry the recommendations on rationalization of subsidies. During world Economic Forum, Jaitley mentioned Government’s plan to reduce the subsidy to 2% of GDP. Government can make it based on Aadhaar card or direct transfer in order to remove leakages and middlemen of distribution system.

IT Sector:

“The role of IT sector is crucial in order to promote e-governance for empowering citizens” – FM, Arun Jaitley

Finance minister had an exclusive pre-budget meeting with heads of Indian IT companies. There were commendable suggestions, which should be considered. First suggestion was to build a data center in India to ensure safety of data and have a network of big software product companies within India. IT is essential for the success of “Digital India” initiative. Under this thought, second suggestion was to increase budget for digital literacy program. India is focused on export of IT services. Government should work to divert its focus to make it product driven industry. According to Prime Minister Narendra Modi, it is possible to have next Google or Facebook in India. Many industrialists have demanded to raise tax slab to Rs. 5Lakhs for IT firms to support digital India initiative.

Real Estate:

Government has to come up with sustainable practice for approving existing and new projects. Government is engaged in building smart cities and National Corridors, in which quick approval of the projects is required. But it should not be at the cost of construction quality. We can expect significant shift in LARR (Land Acquisition, Rehabilitation and Resettlement) Act. Modi government has so far made the amendments through ordinance route. One can expect some liberalization and relaxation in LARR Act to make it align with industry expectation. Government has revealed its indulgence in green practices during U.S. president Barak Obama’s visit. It is further expected to give certain incentives in terms of tax breaks or subsidies for green real estate practices.

Banking Sector :

Government is expected to rejuvenate the public sector banks. Bad loans and non-performing assets have been immutable issues. According to Fitch ratings, state run banks won’t be able to comply with Basel – III norms by 2019. Most of the PSBs are lagging behind in Capital Adequacy Ratio requirement. Government has to come up with capital raising plans to meet the requirements. PSBs require high allocation to uplift investors’ confidence. Government can also roll out divestment plan and reduce government stake from PSBs.

FMCG & Retail Sector:

FMCG’s fortune is directly dependent on propensity to consume and income of consumers. The industry has been waiting for the implementation of Goods and Services Tax since long so that their sales can be boosted. The falling interest rate and lowering of commodity prices will have a positive impact on the disposable income of consumers. FMCG sector was recently suffering from stagnant growth rates and fall in volumes. The increase in disposable income and cut in custom duty specifically in soap segment will be good news for the industry. Growth of companies like ITC may be hampered due to high excise duties on cigarettes segment.

Some other points:

- General Anti-Avoidance Rule – GARR, which was implemented to avoid tax evasion, is expected to be in line with industry expectation by little adjustment in rule.

- Budget for NREGA could be trimmed in this fiscal in comparison to last year’s Rs. 34000 Cr due to its inefficiency and failure to meet targets.

- Health Ministry is going to experience budget cut of Rs 6000Cr compare to previous allocation on account of under utilization.

- We can see further allocations in education sector for 5 new IITs and IIMs.

- As a part of labor reform, government can prohibit child labor, give relaxation in provident fund norms and carry out skill development initiatives.

- Increase in allocation for tourism and biotechnology is expected. Aviation sector is also expected to get tax SOPs for its MRO businesses.

References:

http://www.ficci.com/SEdocument/20316/FICCI-PRE-BUDGET-MEMORANDUM-2015-16.pdf

http://indiabudget.nic.in/

http://timesofindia.indiatimes.com/india/Union-Budget-likely-to-provide-big-thrust-to-Make-In-India/articleshow/45935076.cms

Union Budget: Need to gradually rationalise all subsidies, says FM Arun Jaitley

http://economictimes.indiatimes.com/news/politics-and-nation/budget-2015-trade-unions-demand-hike-in-income-tax-exemption-ceiling-to-rs-5-lakh/articleshow/45924767.cms

http://indiabudget.nic.in/ub2014-15/bh/bh1.pdf

http://www.moneycontrol.com/news/current-affairs/why-gst-will-not-answer-all-our-problems_1257505.html

http://economictimes.indiatimes.com/industry/healthcare/biotech/healthcare/health-ministry-likely-to-face-massive-rs-6000-crore-budget-cut/articleshow/45889674.cms

http://timesofindia.indiatimes.com/india/Telecom-panel-rejects-Trais-3G-spectrum-pricing/articleshow/45944741.cms

http://www.indiainfoline.com/article/news-top-story/%E2%80%8Eindia-real-estate-s-expectations-from-budget-2015-16-115020200078_1.html

http://economictimes.indiatimes.com/news/economy/policy/8-things-the-budget-2015-could-do-cues-from-fm-arun-jaitley/articleshow/46038148.cms

http://businesstoday.intoday.in/photoplay/union-budget-28-february-arun-jaitley-reforms-narendra-modi/1/634.html#photo8

http://www.firstpost.com/business/crisis-looms-over-public-banks-as-no-roadmap-yet-on-govt-capital-infusion-2082989.html

http://www.business-standard.com/budget/article/customs-duty-on-crude-oil-may-be-revived-in-union-budget-115020400301_1.html

Tags: budget India modiYou might like reading:

how to improve the railways ?

Indian Railways is the world’s fourth largest railway network, fourth only to countries like US, Russia and China. It has over 114,000 kms of tracks around the country. It is also the second largest in the world in terms of total employment, direct and indirect with an estimated employee count of over 13.6 lakhs. Managing such an institution is a […]

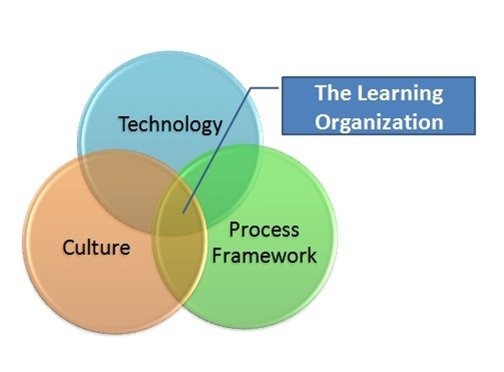

Analysing learning organizations: Boundary-less at GE !

A Learning Organization is an organization that learns and encourages learning among its members. It promotes exchange of information between employees hence creating a more knowledgeable workforce. This produces a very flexible organization where people accept and adapt new ideas and changes through a shared vision. Need for Learning Organization As organizations grow, they lose their capacity to learn as […]