The 2014 general elections yielded historic results. The people of India gave a sweeping mandate to usher in a new era of stable, responsible governance for the inclusive growth of the ailing Indian economy. This election demonstrated the unwavering confidence that the citizens of this country have placed in Narendra Modi. With his landslide victory, he has a mammoth task ahead of him: delivering his promises of political stability, economic growth and transparency, in order to live up to the expectations of thousands of Indians. Immediately with the change in government, the stock market reached a record high with rejuvenated investor confidence, the Indian currency started strengthening and it appears as if the Indian economy is finally back on the right track. However, the geopolitical tension in Iraq and Syria could prove to be a serious threat to this new India’s young and energetic dreams.

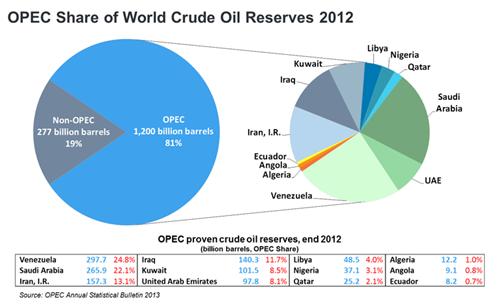

According to the current estimates, the OPEC countries hold about 81% of the world’s total proven crude oil reserves. The bulk of these reserves (almost 66%) are located in the Middle East. [1]

Figure 1: Share of World Crude Oil Reserves 2012.

Source: OPEC Annual Statistical Bulletin 2013

The unrest in Iraq due to the seizure of major cities of the country by the militant group Islamic State of Iraq and Syria (ISIS) threatens to aggravate the oil supply shocks in a market that is already volatile because of domestic turmoil in the other OPEC nations like Libya and Nigeria. As the chaos in Iraq continues, there is a constant risk of the unrest spilling over to the neighbouring oil-exporting regions. With Iraq being a key producer, this raises ominous concerns of supply disruption from this region pushing up oil prices in the global market.

The Indian economy stands largely vulnerable to this impending crisis. The new government plans to take radical steps to reinvigorate the frail economy. The aggressive ambitions of the ‘Modi-Sarkar’ could face a serious setback if global crude oil prices keep rising. India is the fourth largest consumer of crude oil and petroleum products in the world after the US, China and Japan. In order to support the dynamic growth and modernization plans, the energy demand will continue to rise in the coming years. The government has to meet this growing demand through affordable energy supplies. India’s largest energy source is coal, followed by petroleum. Mainly fuelled by petroleum, the transportation sector is all set to expand in the country due to increased focus of the government on improving road and railway transit.

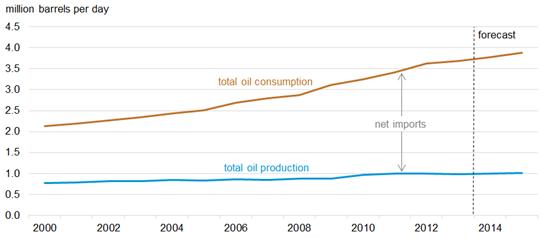

Figure 2: India Petroleum and other liquids production and consumption, 2000-15.

Source: U.S. Energy Information Administration, International Energy Statistics and Short-Term Energy Outlook, June 2014.

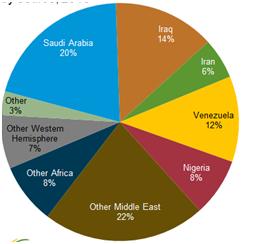

As can be seen from the trend above, the gap between supply and demand for petroleum is widening. The forecasts suggest an ever-increasing consumption trend while total oil production continues to remain relatively flat. To bridge this gap, India is heavily dependent on crude oil imports, mostly from the Middle East with Iraq being the second largest supplier of crude oil (14%) only after Saudi Arabia (20%). Therefore, any crisis in this region has the potential to dislodge the economic revival that the government set out to achieve.

Figure 3: India: Petroleum and other liquid imports by source, 2013

Source: U.S. Energy Information Administration (EIA)

CAD: Reducing the current account deficit has been the priority for the new government; but if the oil prices rise unhindered, this would almost certainly increase the CAD as the demand for crude oil in the country is expected to rise. This in turn, would increase the import bill. With the state coffer almost empty, it will become a challenge for this government to maintain the CAD below 2% of the GDP in order to sustain the Rupee at a favourable value against the Dollar.

Inflation: The transportation sector in the country is heavily dependent on petroleum and the increased transport costs due to rising oil prices trickles down to the price of all essential products and commodities burning a hole in the common man’s pocket. It is estimated that an increase of 10% in the crude oil prices will increase the WPI inflation by roughly 0.7%. The crisis comes at a time when the common man is already battling with the impact of sub-normal and late monsoons on the price of products.

Fiscal Deficit: The government intended to reduce its subsidy burden for fiscal consolidation. Petroleum subsidies represented 33% of the total subsidies for the government in FY14. But the crisis can leave the common man battered due to increasing inflation. This in turn, will reduce the flexibility of the government to manage subsidies due to the painful trade-off with inflation.

The good news:

Most of the known hydrocarbon resources of Iraq are concentrated in the Shiite areas of the south and the Kurdish region in the north, with few resources in control of the Sunni minority in central Iraq. Iraq has five super-giant fields (over 5 billion barrels) in the south [2]. Presently, the ISIS has established a stronghold in northern Iraq and there is no immediate danger of disruption of supply from the southern part of the country that accounts for 60 percent of its proven oil reserves and hence, the bulk of Iraq’s oil production remains secure.

The oil market is a speculative market and is currently being driven by fears and uncertainties. Fields and facilities in the south are safe but the political tension in the country has created anxiety in the market. As long as southern Iraq is secure, which is likely to remain so as the risk of the country collapsing is remote, the stability of the global oil market will not be threatened. Besides, the American intervention will also help ease the tension.

Also, according to the RBI governor, Raghuram Rajan, the ISIS crisis does not provide a cause for concern, at least in the short term. India is riding high with foreign institutional investors, which has set a positive tone for market sentiment. $7.7 billion in foreign investment has already poured into domestic bonds, yielding returns of 8.5 percent. The CAD, which was extremely high at $21.8 billion in June 2013, had fallen sharply to $4.1 billion by December. Also, India’s foreign exchange reserves have increased from $275 billion in August 2013 to $312 billion in June 2014. [3]

The way forward:

The impact of the Iraqi crisis on the Indian economy may seem controllable at present; however, it has exposed deep set vulnerabilities in the Indian oil ecosystem. This crisis has given us the opportunity to re-think our national and economic policies and understand how we could stand resilient to any such geopolitical contingency in the future.

- The government must invest in building strategic petroleum reserves (SPRs) in the country that can hold enough oil to support India’s energy requirements for a minimum period of 3 months. Such reserves will enable us to withstand the global economic turmoil due to crises in oil-exporting countries. India could take a cue from the SPRs maintained by the US Department of Energy which have the largest emergency supply in the world of up to 727 million barrels.

- The extremely heavy energy dependency of India on the volatile Middle Eastern countries must be reduced. To do this, India can, on the short term, consider diversifying her oil imports. The government should also seek to invest in alternative sources of energy, including hydropower, solar, wind, biomass, geothermal, nuclear etc., to make India energy independent and self-sufficient, while continuing the exploration for new oil fields.

- Indian oil companies like ONGC Videsh could enter into strategic partnerships and joint ventures in other countries to procure crude/refined oil.

- India has rich reserves of thorium, which could be well utilised to expand her nuclear energy production, thus increasing her energy security by reducing the dependency on fossil fuels.

- The government must try to invest in research and development to increase vehicular efficiency. It must also encourage good road condition, surface preparation, and traffic management for increasing fuel efficiency.

All of these measures taken together can help sustain the development that the government wants to achieve by increasing India’s energy security through reduced dependence on fossil fuels and hence, reduced dependence on the turbulent Middle East.

References:

- OPEC, http://www.opec.org/opec_web/en/data_graphs/330.htm

- U.S. Energy Information Administration, http://www.eia.gov/countries/cab.cfm?fips=in

- The Diplomat, June 25th, 2014, Iraq Crisis

You might like reading:

IIM Rohtak PGP Final Placement 2016: 48 recruiters on campus

IIM Rohtak is proud to announce the conclusion of its final placement process for the academic year 2014-16. The institute witnessed participation of multitude of companies across varied domains. 145 students of PGP05 batch successfully availed opportunities across diversified profiles and various functions in the organizational setup. Our corporate visitors were delighted to see the enthusiasm students exuded in the placement process, which was […]

Taking off in the MBA flight

In the beginning of the movie Batman Begins, when Bruce Wayne finally scales the mountain and reaches Ra’s al Ghul, he is huffing and panting. Ra’s: Are you ready to begin? Bruce: I… I can barely stand. And then he gets kicked to the ground. A couple of more blows later, Bruce finally starts to defend himself, puts up a […]