Working of Stock Exchange in India

When any owner / founder want to set up business/company, he has to put funds from his pocket. But there is no sufficient growth. Even if he taken loan from the banks, he might could not repay the loan. So, company comes to public to raise funds; ask public to invest money via trading with assurance in some return. They expect to use these funds in proper way to expand business and make profit for the company. Thus, Stock exchange is an organization which interferes between company and investor to raise funds for the benefit of company as well as investor. It provides employment opportunities and also results to boost economy.

Indian exchange consists of two types:

- STOCK EXCHANGE (BSE, NSE & OTHER REGIONAL EXCHANGES)

- COMMODITIES EXCHANGE (MCX etc).

India consists of 22 stock exchanges overall under government regulation. Most Prominent stock exchange is Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) as most of the trading is done in these exchange. BSE is the oldest stock exchange in Asia established in 1875 while NSE is established in mid 1990s. Index is the benchmark of both stock exchange for tracking of market status or checking upward or downward movement of stock. It consists of basket of stocks of companies which are listed under exchange under regulation of SEBI. Sensex is an index for BSE which comprises of 30 constituents while Nifty is an index for NSE which comprises of 50 constituents.

After scam of famous stockbroker “Harshal Mehta”, The Security exchange board of India (SEBI) is established in 1992 which can regulate the business in the stock exchange. It controlled and prevents unfair trade practice in stock exchange. Only those companies who are registered under respective exchange and SEBI can do trade or invest in stocks. If unlisted companies want to register in exchange; they need to satisfy various conditions and have to follow various formalities. Such companies need to send application letter to stock exchange for registration. In term of allocation of funds, companies needs to complete allocation of securities to public within 30 days of the date of closure of subscription and after that they have to approach stock exchange for approval. The company raised funds by offering securities to public, this process called Initial Public Offering (IPO). Such type of market called “Primary market”. After that, shares are given to investors; investor can buy or sell shares from their choices of companies i.e. share get traded. This market is called “Secondary Market”.

An individual investor or company who buys or sells stocks on behalf of another person or company who takes care of actual selling or buying is called stockbroker. These brokers takes commission from investors for both buy and sell side transaction, called brokerage charge. There are many brokers available to serve this purpose; some of them are: ICICI securities, Axis Securities, Angel broking, Share Khan, LKP securities, India bull securities etc. Every broker might have different brokerage charge depending on their policies and services. There is no any price range for brokerage charge. These brokers not only trade stock on behalf of clients but also provide recommendation of good stocks to buy or sell. Many of them provide call-n-trade and online trading facility for ease of clients. So, for any Indian investor wants to enter into market, need to open Demat account with any brokers for selling or buying of stocks

Now, there are various options to trade and invest: Equities, Derivatives, Mutual funds, Future & options, Fixed Deposit and Bonds, Currency. Equities have highest potential for growth compare to others. Since 1990s till date, Indian stock market has given return about 17% to investor on an average in terms of increase in share price. Equity markets follow T+2 rolling settlement. It means trading taken place on Monday, gets settled on Wednesday. All trading on stock exchanges takes place between 9:55 am and 3:30 pm from Monday to Friday. Trading generally followed certain steps. The money needs to be allocated in demat account from bank account. In demat account; cash will get converted to electronic format. For choosing stocks of companies, one need to study of company history, profit/loss over the years, expected future growth of company by doing fundamental analysis and technical analysis, ,recent announcement of companies ,new projects etc . As investor chooses stock of companies, he firstly needs to choose exchange e.g. BSE or NSE. Before buying stocks he needs to know types of orders he can place with broker. Market order is fastest and easiest type of order. It implies that one is going to buy or sell share on current market price on live session. Other type is Limit order. Here, one can decide price at which he wants to buy or sell. For example: Let ONGC trading at Rs.800 per share and trader want to buy it. But you feel you could get it in lower price, so instead of buying at market price, 800 Rs, you can put a limit order of 790 Rs. If ONGC share falls to Rs. 790, the order will get executed. One more important factor is stop-Loss which helps to protect from loss. Suppose one buy share of ONGC for Rs 800 and given stop loss at 755 Rs. Instead of rising, suppose it falls to 755 Rs., shares of ONGC automatically get sold to avoid more loss. It means stock loss got limited to 5%.

There is different classification of investment in Indian stock exchange. 1

. A person buys or sells shares on same day; it’s called Intra-Day trading. It has capabilities to give huge profit but so much risky that one can enter into huge loss if stock collapsed.

- A person buys or sells in short duration for say 1 week to 6 months, it’s called short-term trading.

- Another class of people who buy and invest stock for 3 to 6 years in huge amount, such type of investment is called long-term investing. It is more recommended as shares of top companies shown valuable appreciation in price in stocks over the years and many made huge profits.

Now, another option of investment is Derivatives. It is contract between 2 parties which is based on financial product including gold .It is based two cases: Future and Option trading. Mutual Fund is also is also common form of investment. Here, intermediate body (fund manager) pools funds from investor and invest in stock exchange on behalf of investor. Profits incurred by mutual funds would to be return to investor. The mutual fund schemes are differ according to risk aversion. Due to daily International activity in market, currency prices shows up-down movement. It is called Currency Trading”. Now, let us consider about “commodity exchange”. Central government of India allowed trading all goods and products of agriculture and minerals. It’s main aim to facilitate exchange of commodities between buyers and sellers, thus reducing the risk.

There are basically three types of market trends: Bull market, Bear and sideway market. Bull market is very profitable for most investor. Many people are eagerly looking to buy more stocks with assurance that market will go up. Sometimes market falls continuously over the month, sensex or nifty starts decline; and then it is called Bear Market. In Sideways market, market neither go up or down. It ends in original position letting investor to hold the stocks. Many times, market shows upraises movement in index to around 10% to 20%, but suddenly falls down to some extent is called correction phase. It is used to bring stability in the market so that more people can attract to buy stocks. Before choosing any company stock, it is very important to analyze company related information so that after buying stock one should not end into loss. There are two ways from which one can analyzes stock of companies: Fundamental analysis and Technical Analysis. In fundamental analysis, investor looked at past performance of company, movement in stock price and future growth of company. In technical analysis, stocks of companies are chosen by analyzing statistical data generated by market activity which can gives accurate prediction of future company performance.

Indian market shown higher volatility compared with other emerging market. The volatility of Indian market is almost 5 times the volatility of market of developed nations. The higher volatility is due to increasing ratio of foreign equity inflows to domestic equity savings. Volatility is depending upon upward and downward movement of stocks price. There are many factors which influence Indian stock market. Factors effecting production rate are inflation, rainfall, currency movement, gain production, political announcement etc. Also change in excise duty, sales, tax and effect CRR, SLR also affects markets .Foreign companies also invest in India in the form of foreign direct investment and foreign portfolio investment. The investor needs to be register as FII to establish portfolio in India. FIIs mainly consist of mutual funds, pension funds, wealth funds, insurance companies, banks, asset management companies etc. As of now, India doesn’t allow individual foreign investment to invest directly in Indian stock exchange. The government of India prescribes FDI in different sectors. Its criteria fall in the range from 26% to 100%, depending upon sectors.

Currently, only a very low percentage of the individual Indians are invested in the domestic stock market, but with growing GDP in future, we might see more money comes into market.

Reference:

- Debjiban Mukherjee ,T. A. Pai Management Institute, Manipal, India ,”Comparative Analysis of Indian Stock Market with International Markets”.

- Shodhganga@INFLIBNET Centre, article on History & Evolution of Stock Exchanges in India

- Jitendra Gala, “Guide to Indian Stock Market:How to become Millionaire in Stocks”

Bibliography:

1. An Introduction to the Indian Stock Market

2. http://www.investopedia.com/articles/stocks/09/indian-stock-market.asp

3. http://www.svtuition.org/2009/06/working-of-stock-exchanges-in-india.html

Tags: sebi Stock exchange Stock market in IndiaYou might like reading:

IdeasClash 2.0- Business article writing competition

1. The contest is open to Indian nationals only. 2. The article should be original and free from any form of plagiarism. If found to have plagiarism, the article will be immediately disqualified from the contest. All sources and references for data should be properly mentioned.The topics for article submission are: i.Economic analysis of any Euro zone country excluding […]

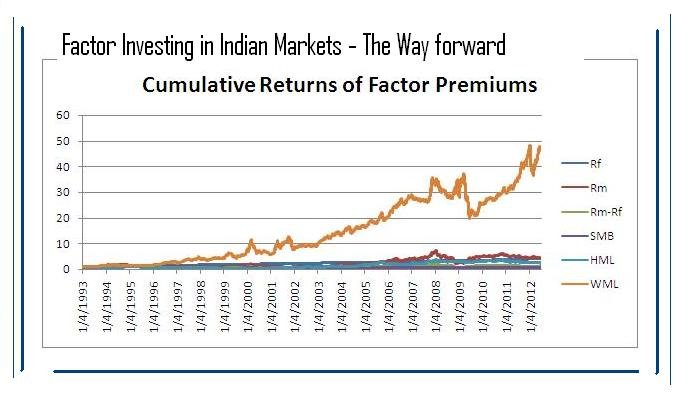

Regime Switching and Factor Investing in India

Global investment management industry is constantly evolving and undergoing a rapid shift in its view and understanding of financial markets and investment management. This article persuades the readers of the need for change in Indian investment management industry in order to catch up with the global innovations. Two recent paradigm shifts in the developed markets – Regime switching and factor […]