In its golden jubilee year, continuing with the legacy of JBIMS, the first MSc. Finance batch witnessed stellar placements. Launched in 2013, MSc. Finance is the first of its kind course focusing on creating industry –ready financial professionals’ right out of B -School. Having a batch of only 30 students, it has a good representation of the students from varied educational and professional backgrounds.

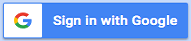

Experience Profile

The course has managed to build industry relations with more than 45 corporate organisations for summer and executive placements.

Recruiters

A few of the marquee organisations include Goldman Sachs, PWC, Aditya Birla Group, Trafigura, ICICI Bank, SREI Infrastructure, BNP Paribas, ICICI Prudential, Axis Securities, DE Shaw, Indus Valley Partners, HDFC Bank, Religare, Essel Finance ,Olam International, Axis Bank, Motilal Oswal, IIFL, IBM, Abbott Laboratories, SBICAP Securities among other organisations.

Highest Package: ₹ 19.7 LPA ; Highest Stipends: ₹ 1.5 Lac

The median package for executed placements stood at ₹13.1 LPA.

The average stipend offered to the students stood at ₹ 60,000.

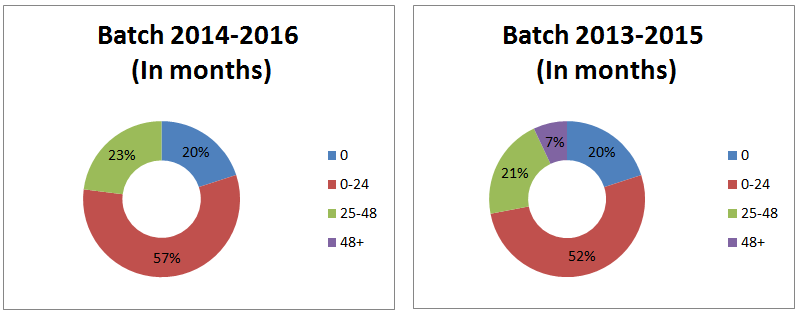

Leveraging the deep financial acumen of the students, the intensive course curriculum has managed to land them across various financial domains and leadership roles in finance.

The Placement season saw participation from Investment banks, Commercial Banks, Consulting firms, financial services companies, conglomerates, and many other companies from the service sector.

Some of the most coveted profiles in the Investment Banking industry like M&A advisory, Private Equity, Transaction advisory, and Trading & Hedging along with other traditional roles like Corporate Banking ,Corporate Finance, Risk Management, Currency Trading, Treasury Management and Financial Planning & Strategy were also offered.

Read JBIMS MBA Placements: https://ideasmakemarket.com/2015/04/jbims-placement-report-2015.html

Read JBIMS MBA vs MSc. Finance: https://ideasmakemarket.com/2015/05/msc-finance-vs-mba-finance-jbims.html

Tags: JBIMS MSc Finance PlacementsYou might like reading:

My interview experience at NMIMS, Mumbai – Pritam Mukherjee

NMAT – 208, MBA Core Merit Rank – 56, MBA HR Merit Rank – 71 MBA Core 3 panel members. P1- Prof (lady) aged about 35. P2- Alumni aged about 35. P3- Prof aged above 60. Most of the questions were asked by P2. Only two questions by P1 and no word was uttered by P3 (he just observed). Don’t […]

Development of Banking sector & Financial markets- India perspective – Part 2

Credit Market: The key objective is to efficiently allocate savings to productive sectors of the economy. Starting early saw the introduction of a liberalized regime to increase efficiency and reduce net performing assets ( NPA’s) in the banking sector. Interest rates were deregulated and entry of new private sector banks was allowed, besides enhanced presence of foreign banks. On the […]