|

S.No.

|

Store Code

|

Year

|

|

1

|

PNE001

|

1995

|

|

2

|

PNE002

|

1995

|

|

3

|

PNE003

|

1997

|

|

4

|

PNE004

|

1998

|

|

5

|

PNE005

|

2001

|

|

6

|

PNE006

|

2003

|

|

7

|

PNE007

|

2004

|

|

8

|

PNE008

|

2006

|

|

9

|

PNE009

|

2008

|

|

10

|

PNE010

|

2012

|

|

11

|

PNE011

|

2012

|

|

Category

|

Establishments (Nos.)

|

Employment(Nos.)

|

|

Shops

|

11,718

|

28,866

|

|

Commercial Establishments

|

22,925

|

193,557

|

|

Hotels

|

3,967

|

9,237

|

|

Theatres

|

30

|

313

|

|

Total

|

38,640

|

231,973

|

|

Source: Pune Municipal Corporation: Environment Status Report, 2005

|

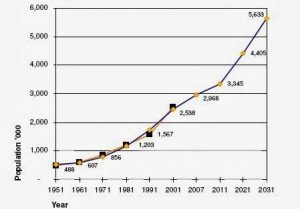

Exhibit 3: Population Growth Estimate

|

Year

|

Average net sales growth per store in %

|

|

2005-2006

|

45

|

|

2006-2007

|

42

|

|

2007-2008

|

35

|

|

2008-2009

|

24

|

|

2009-2010

|

20

|

|

2010-2011

|

34

|

|

2011-2012

|

29

|

|

2012-2013

|

25

|

|

Activity

|

Cost as % of Sales(Year 2012-13)

|

|

Rent

|

12%

|

|

Electricity

|

2.50%

|

|

Employees

|

5.50%

|

|

Maintenance

|

2%

|

|

Promotional Activities

|

1.50%

|

|

Others

|

6%

|

|

Total

|

30%

|

|

Year

|

Operating Profit Margin

|

|

2005-2006

|

11%

|

|

2006-2007

|

11.50%

|

|

2007-2008

|

9.80%

|

|

2008-2009

|

7.60%

|

|

2009-2010

|

7.20%

|

|

2010-2011

|

8.20%

|

|

2011-2012

|

7.80%

|

|

2012-2013

|

7%

|

You might like reading:

Managing the stages in investing life cycle

For any investor, the time he fixes a goal in mind, his investing life cycle starts. Rest of his activities involves going through each stage of this cycle and end the journey at the time he is achieves the goal by selling the stocks. With or without knowledge, no investor would be able to avoid any stage of this process. […]

Be a sponge for knowledge and new skills but with conscious determination, says Prof. Sreeram

IdeasMakeMarket.com recently caught up with Prof. Sreeram about his journey and key lessons in life. Prof. Sreeram is a celebrated teacher, trainer, consultant, published researcher and case writer. He spent over a decade at the School of Business Management, NMIMS, Mumbai, perfecting his active learning methodology. His academic career was prefaced by 11 years in a corporate career, including sales […]