Overview

The Indian Aviation industry is the 9th largest civil aviation market in the world and is ranked 4th globally in domestic passenger volumes. The industry handles about 2.5 billion passengers annually and has about 87 different airlines flying to & from India.

Some facts and figures with respect to the aviation industry:-

Total Passenger Traffic in FY12 – 60 million

Total Freight Traffic in FY12 – 2.26 million tonnes

As per DIPP data, FDI from Apr, 2000 to Mar, 2013 – US$ 449.26 million

Under the 12th 5-year plan, airport infrastructure investment – US$ 11.4 billion (estimated)

|

Parameter

|

2000

|

2012-13

|

|

No. of Aircraft

|

125

|

369

|

|

No. of Operational Airports

|

50

|

125

|

|

Passenger Handling Capacity at Airports

|

66 million

|

233 million

|

|

Scheduled Airlines: Distance Flown

|

199 million km

|

762 million km

|

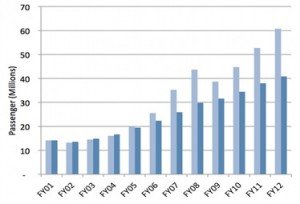

The below chart gives an overview of international and domestic passenger traffic trends between FY01 and FY12:-

- Trends, as per the past decade, show a 300% increase in the domestic passengers, and 160% in international passenger traffic

- Domestic passenger traffic expanded at 15.6% compound annual growth rate (CAGR) over FY06-12

- International passenger traffic expanded at 10.5% compound annual growth rate (CAGR) over FY06-12

Key Performance Indices

Load Factor = % of [Occupied Seat/Available Seating Capacity]

Revenue Passenger Mile = No. of Revenue Payers * No. of miles flown in a period

Revenue per Available Seat Mile = Revenue/No. of Seats available

Available Seat Mile = No. of Seats Available * No. of miles flown during given period

Air Traffic Liability = Estimate of money already received

Major Revenue and Expense Areas

|

Revenue Areas

|

Expense Areas

|

|

Freight

|

ATF

|

|

Passengers

|

Crew

|

|

On-Board Sales

|

MRO

|

|

Cost for carrying luggage

|

Passenger Services

|

Porter’s Five Forces Analysis

|

Five Forces

|

Analysis

|

Impact

|

|

Threat of New Entrants

|

High capital requirement

Existing customer loyalty to established brands

Inadequate airport infrastructure

Shortage of qualified pilots

High fuel cost

|

LOW

|

|

Threat of Substitute Products

|

Large no. of substitutes like railways, buses, cars etc.

High buyer switching cost with respect to time

High buyer propensity to substitute with respect to cost

Ease of substitution for short distances

|

LOW

|

|

Bargaining Power of Buyers

|

Travel agents act as middle men for Business and Regular travelers providing them the best option for a travel

Buyers have access to large amount of information online

High cost involved in switching airplanes

No major differentiation in services of airlines

|

LOW

|

|

Bargaining Power of Suppliers

|

Very few suppliers due to high expertise required – Only two major global aircraft manufacturers – Boeing and Airbus

The products delivered by the suppliers are extremely standardized

Eco-friendly planes manufacturers getting an edge

High switching costs to change suppliers due to contract obligations

|

HIGH

|

|

Intra Industry Rivalry

|

High price rivalry

High fixed costs and input constraints

Most airlines earn low returns due to high cost of competition

|

HIGH

|

Competitor Analysis

Given below are some of the major players in the Indian Aviation industry and their financial figures and performance statistics:-

|

Parameters

|

Indigo

|

SpiceJet

|

JetLite & Jet Airways

|

Air India

|

Go Air

|

|

Market Share

[May 2013]

|

29.50 %

|

19.80 %

|

22.50 %

(JetLite – 5.40%)

|

19.10 %

|

9.00 %

|

|

Passenger Load Factor

[May 2013]

|

89.60 %

|

80.90 %

|

76.15 %

|

82.00 %

|

85.80 %

|

|

On-time Performance [OTP]

[May 2013]

|

95.00 %

|

85.20 %

|

91.80 %

|

89.20 %

|

89.40 %

|

|

Cancellation Rate [May 2013]

|

0.10 %

|

0.80 %

|

0.50 %

|

0.70 %

|

0.40 %

|

|

Airline Debt

[in USD billion, FY 2013]

|

0.1

|

0.2

|

2.1

|

9

|

0.07

|

|

Revenue

[in USD billion, FY 2013]

|

1.5 – 1.6

|

1.0

|

3.0 -3.5

|

3.0

|

0.4

|

|

Net Income

[in USD million, FY 2013]

|

100 – 110

|

(34)

|

(90 – 100)

|

(950)

|

(14 – 16)

|

Key Insights:-

- SpiceJet has a high cancellation rate, which ultimately is affecting its market share

- Air India’s debt is approximately twice that of all the other carriers in India combined (taking Kingfisher’s debt of 1.8 billion USD)

- Indigo scores the best on all the parameters. Except Indigo, all airlines are suffering loses

- The three Low Cost Carriers combined account for just 4-5% of total industry debt and this is largely aircraft-related

- Combined loss of over 1.1 billion USD in FY2013

- Over 9.5 billion USD revenue in FY2013, down from 2.28 billion USD of previous year

- The market share of Jet Airways and Jet Lite has shown a decrease over the year, while others are filling up the vacancy left by Kingfisher

- Passenger load factors of all except kingfisher and Air India has not changed significantly, Indigo above 80%

Aviation Turbine Fuel (ATF)

Financial Highlights

- IATA estimates that for every 1 USD increase in average price of barrel, a recovery of around 1.6 billion USD is required

- Airline industry fuel bill rose to 177 billion USD as price of oil barrel rose by 20 USD in 2011

- The barrel price rose by 10-12 USD by the end of 2012

- Recent News

- The Direct ATF Import Policy was approved in 2012 but could not be implemented because of lack of infrastructure

- 76% (SPV’s) of equity would be owned by AAI and State owned oil marketing companies

- 24%(SPV’s) would be owned by airlines

Implications

- ATF costs for Full Service Carriers (FSC’s) is around 30-45% which rises further to 40-55% for the Low Cost Carriers (LCC’s)

- The ATF prices are linked to fluctuations in crude oil prices in the global market and movement of INR vs $

- The higher central and state levied taxes makes the price of ATF 60-70% higher than global average

- With the direct ATF import it is expected that airfares will come down and passenger load factor for each airline would increase

Recent Happenings in Indian Aviation Industry

-Qatar Airways keen on tie-up with GoAir

- This will help increase the current market share from 4.4%

- Bilateral traffic rights of seats will increase from 24,000 to 72,000 seats per month

- Bring in the highly sought dollars through FDI

-Air India to acquire 19 Airbus A320s

- Done in bid to compete with low cost airlines

- The deal is to dry-lease the aircrafts for 6 years

-Mobile Store partners with Jet Airways’ JetPrivilege

- Benefit of earning JetMiles on purchase of mobile phones and tablets both online and at retail stores

-Air Asia and Tata (Telestra) joint venture

- Low cost to be achieved by providing high volumes

- Direct competition to SpiceJet

Milestone Events in Indian Aviation Industry

Downfall of Kingfisher Airlines

- Since its commencement in 2005, it grew steadily and had the 2nd largest market share till the end of 2011

- License suspended in October, 2012 and in February, 2013 DGCA withdrew both domestic and international flight entitlements

Jet-Etihad Deal

- Bilateral air service agreement signed between India and Abu Dhabi

- The deal was announced on 31st January 2013 but ran into problems with SEBI in July, 2013

- As of today, no new demands have been made by agencies like the Foreign Investment Promotion Board, Cabinet Committee on Economic Affairs and SEBI but the approval from CCEA is still pending

Air India signed MOU with Adria Airways

- Both the airlines plan to sign a “code share agreement” shortly

- MOU to pave way for better commercial viability

- An increase in domain of operations for both the airlines

Growth Indicators

FY’13 Budget

- In the Union Budget for FY13 the Finance Minister has proposed support worth USD 58.3 million to AAI to develop airport infrastructure in north eastern states

- Aviation Regulator DGCA has been allocated USD 12.5 million for implementing developmental plans

Focus on Infrastructure

- Under the Twelfth Five Year Plan(2012-2017), Government of India have set aside USD 11.4 billion for infrastructure investment and development

- GOI have plans to invest around USD 30 billion in next 10 years to open new airports and modernize the existing ones

- 100% tax exemption for airport projects for period of 10 years

FDI Policy

- 100% FDI under automatic route for Greenfield projects

- 100% FDI for existing projects with automatic route up to 74% and Government route beyond 74%

- 49% FDI in civil aviation sector for foreign players

Liberalization and Open Sky Policy

- Increased traffic rights under bilateral agreement with foreign countries

- Approval for Greenfield Airports in 2008

- New regulatory body (Airport Economic Regulatory Authority) set up in 2009

Increase in Demand

- Increase in people travelling by air

- Rise in tourist travelers- almost 19% last year (Source: Tourism report)

- Strong growth in external trade- 14% increase

Challenges in the Indian Aviation Industry

Poor Infrastructure

- Delay in take-off and landing because of below par infrastructure

- High Airport charges is also attributed to it

- Stifling growth rates further mar the work done by government in this industry

Volatility in Fuel Prices

- High import price of fuel

- Profit margins go down because of the high ATF prices

- Customers are the end losers as the cost is recovered from their pockets

Company specific reasons

- Lack of focus as in case of kingfisher when it transformed from Low cost economic airline to an airline catering to business class people

- Faulty M&A decisions- Kingfisher-Air Deccan, Jet-Air Sahara

Future Outlook

The Indian market is severely underserved as only about 2% of population uses airline as a mode of transport. This market can be easily tapped. Moreover with the increasing per capita income of the people and consistent market growth rate of around 5-7%, there is a lot of scope for this industry.

[The article has been written by Debleena Banerjee & Sanket Tandon. They have completed their MBA (IB) from IIFT, Kolkata.]

You might like reading:

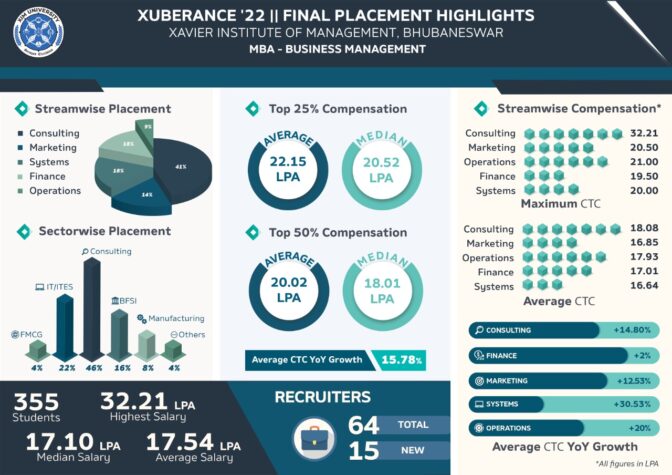

XIM, Bhubaneswar accomplishes 100% placements for its 34th Batch

Established in 1987, Xavier Institute of Management, Bhubaneswar is a premium B-school in the country with a rich legacy of grooming leaders of tomorrow. The two-year flagship Business Management program has consistently been ranked as one of the finest business curriculums in the country. Carrying forward its rich legacy of over 34 years of management education, we believe in imparting […]