1. Introduction – A Curious Crowd

What can be common between Dal Vadaa sellers, taxi drivers, dhobis, farmers, factory workers, small businessmen, roadside cobblers and tea vendors? Many are self-employed, earn in cash, have irregular incomes, rely on moneylenders for funding needs, and have almost indecipherable credit worthiness. Usually, banks shun them. But not GRUH Finance…..

2. Company Profile

2.1. Sparking the Renaissance

GRUH Finance, formerly known as the Gujarat Rural Housing Finance Corporation, is India’s first specialized rural mortgage entity for the underserved and informal sector. It is the brainchild of HDFC’s founder, the late HT Parekh, who believed that there was a need for an institution to go to smaller towns and villages where the credit economy operates in a largely informal manner. Thus while GRUH catered to rural and semi urban areas, HDFC catered to the urban segment, thus complimenting each other.

GRUH’s initial forays into rural sector, gave more insight than business, as they quickly realized that housing demand wasn’t very high in rural, where almost everyone had some sort of housing, and they usually needed loans for farming purposes. With this learning the company quickly shifted focus to urban areas and began to work on a niche where it financed the first homes for low-income borrowers.

2.2Hurdles Galore

The journey has been tough for GRUH. Earlier, the business was highly regulated by National Housing Bank., which stipulated both the borrowing and lending rates, leaving a measly spread of 0.75% between them. Another classic challenge was to change the mindset of rural home buyers, conquering their debt adverse nature, and wean them from the local moneylender.However, the real challenge lay in determining the credit worthiness, of its varied and unique borrowers.

2.3To Give Or Not to Give?

GRUH’s present model is the brainchild of Sudhin Choksey, the company’s managing director. Firmly believing that integrity and character has nothing to do with income levels, he got the board to approve lending a small amount of 2 crore, initially, without formal documentation. During the next 5 years, a comprehensive model to determine the credit worthiness was documented.

The technique is intensive and involves working with individual borrowers to understand their income patterns. Next come interviews with his neighbors, a copy of his bank statement, educational records and so on. Finally the company determines the loan amount. It also lends, only to those wishing to buy first house, and that too, only 70% of the total amount, thus capping its credit risk.

As, business began to grow, GRUH formalized its own assessment system. Today, once a borrower’s income details have been verified, all data is put in software that looks at 23 parameters to determine eligibility. Once recorded, the computer calculates an interest rate, which cannot be tampered with.

3. Financial Scrutiny

3.1 Risks to Business

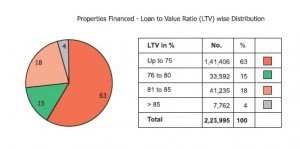

LTV is the ratio of loan given against the value of the collateral. The lower the ratio, the lower the market risk. For example, if for a property worth Rs 60 lac a loan of Rs 25 lac is given, the market risk is low.

In case of GRUH Finance, the LTV is less than 80% for approximately 78% of the properties financed so far and LTV greater than 85% exists only in case of 4% of the properties financed. Therefore, the overall market risk remains low for the company.

3.2 Non Performing Assets

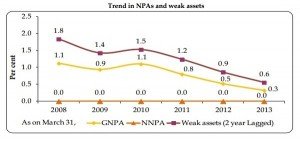

If a borrower stops payment of EMI for 3 months, the bank considers the loan (asset) as non-performing. Thanks to GRUH’s stringent credit assessment standards, the NPA’s are getting less. What is more striking, is that their NPA’s are already below the industry standards.

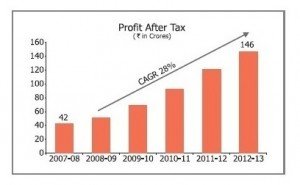

3.3 Profit After Tax

The average annual growth in Profit after tax has been 28% for the past 6 years, which is quite striking. Funnily, the growth will be more or less sustainable, as there is a huge demand, and lack of a credible competitor, with equal strength. In fact, it is targeting a growth rate of 30%, that too without straining its balance sheet heavily.

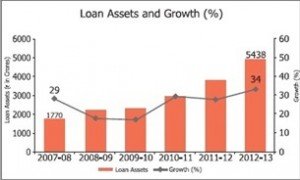

The loan assets have been growing steadily. From a measly 1770 crores in 2007-08, to 5438 crores in 2012-13, it has generated a CAGR of 25.17% over 5 years.

4.The Path Ahead

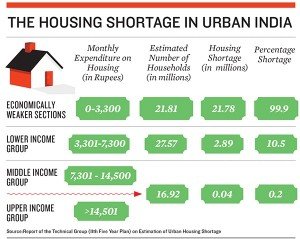

4.1 Immense potential market

With two-thirds of India’s 1.2 billion population residing in the hinterland, this is a huge market for mortgage players. According to a 2010 Monitor inclusive markets report, the market for rural mortgages in India in the Rs. 3 Lakhs to Rs. 10 Lakhs band comprises more than 20 million households and is a Rs. 1,000 billion market. Another report from the Boston Consulting Group and the Federation of Indian Chambers of Commerce & Industry estimates that the total home mortgage market in India would increase from around US$110 billion in March 2011 to a whopping US$800 billion by 2020.

4.2 Boost from the Government

To boost the economy, one of the sectors that the government is focusing on is low-income housing. It has given permission for External Commercial Borrowings in 2012-13 Budget.

In August, the National Housing Bank (NHB), the nodal agency for housing finance in India, slashed the interest rate by 1% on refinance to banks and HFCs on loans up to Rs. 5 lakhs to boost affordable finance for low income homes in urban areas. On October 31, the NHB launched the Credit Risk Guarantee Fund Scheme to trigger the credit markets with loans up to Rs. 5 lakhs for providing housing to the economically weaker section of people. Thus informal sector will be getting some long desired financial backing.

4.3 Competitors Swarming In…

There are almost 40 developers in the developers in the low-income housing segment. Firms like Tata Housing and Value and Budget Housing Corporation (VHBC) set up by Bangalore-based Jerry Rao have launched homes in the Rs. 7 lakhs to Rs. 5 lakhs price bracket. Mahindra Rural Housing Finance,is providing housing mortgages to its automobile customers. Even as GRUH lends only to home buyers and not developers, increasing competition will put pressure on margins — GRUH’s average spread is 2.5% to 3%

4.4 But Miles to Go…. Before GRUH stops.

However, even the presence of competition cannot impede the journey of GRUH significantly. For it has an unmistakable moat which is nearly impossible to replicate, its unique credit appraisal system.

It has also got aggressive growth plans. It has expanded its business to semi-urban and urban destinations outside Gujarat and is now present in several other states including Maharashtra, Rajasthan, Chhattisgarh, Karnataka and Tamil Nadu. It has also targeted areas in the outskirts of Mumbai, where customers are easy to access, and real estate prices are also reasonable.

However, showing signs of maturity, it is against pursuing growth blindly. Even being conservative, they are targeting a growth of about 30% each year. Not only that, it is the only finance business in the country that provisions for every NPA at the end of every year and so its net profits are understated. Thanks to their stringent assessments, the company’s gross non-performing assets are down to 0.52% compared to 5% in the late 1990s. Finally the fact that it gives away close to 40% of net profit as dividends, makes it an investors’ darling.

[The article has been written by Rituparna Kar & Sudipta Bannerjee. They are presently pursuing their MBA from ISWBM, Kolkata]