|

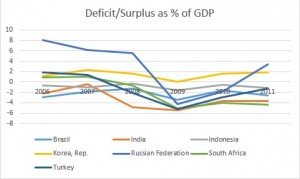

Country Name

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

|

Brazil

|

-2.88

|

-1.87

|

-1.21

|

-3.47

|

-1.67

|

-2.58

|

|

India

|

-2.24

|

-0.47

|

-4.87

|

-5.42

|

-3.64

|

-3.68

|

|

Indonesia

|

-0.62

|

-1.02

|

-0.34

|

-1.67

|

-0.56

|

-1.14

|

|

Korea, Rep.

|

1.14

|

2.32

|

1.64

|

0.02

|

1.65

|

1.82

|

|

Russian Federation

|

8.02

|

6.19

|

5.62

|

-4.21

|

-1.91

|

3.37

|

|

South Africa

|

0.91

|

1.08

|

-0.68

|

-5.14

|

-4.04

|

-4.35

|

|

Turkey

|

1.90

|

1.41

|

-2.15

|

-5.25

|

-2.92

|

-1.29

|

|

Country Name

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

|

Brazil

|

55.75

|

57.39

|

56.63

|

60.00

|

52.21

|

52.79

|

|

India

|

59.11

|

56.48

|

56.11

|

54.31

|

50.43

|

48.50

|

|

Indonesia

|

38.93

|

35.18

|

33.14

|

28.36

|

26.10

|

26.22

|

|

Russian Federation

|

9.89

|

7.16

|

6.50

|

8.70

|

9.33

|

9.52

|

|

Turkey

|

51.50

|

44.35

|

44.66

|

53.56

|

50.94

|

45.92

|

|

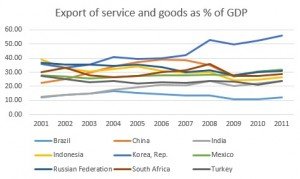

Country Name

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

|

Brazil

|

12.18

|

14.10

|

14.99

|

16.43

|

15.13

|

14.37

|

13.36

|

13.66

|

10.98

|

10.87

|

11.89

|

|

China

|

22.60

|

25.13

|

29.56

|

33.95

|

37.08

|

39.13

|

38.41

|

34.98

|

26.71

|

30.61

|

31.37

|

|

India

|

12.38

|

14.05

|

14.71

|

17.55

|

19.28

|

21.07

|

20.43

|

23.60

|

20.05

|

21.94

|

23.88

|

|

Indonesia

|

39.03

|

32.69

|

30.48

|

32.22

|

34.07

|

31.03

|

29.44

|

29.81

|

24.16

|

24.62

|

26.33

|

|

Korea, Rep.

|

35.74

|

33.13

|

35.37

|

40.88

|

39.27

|

39.68

|

41.92

|

53.01

|

49.73

|

52.28

|

56.16

|

|

Mexico

|

27.56

|

26.82

|

25.35

|

26.61

|

27.10

|

27.97

|

27.93

|

28.05

|

27.72

|

30.31

|

31.67

|

|

Russian Federation

|

36.89

|

35.25

|

35.25

|

34.42

|

35.20

|

33.73

|

30.16

|

31.31

|

27.94

|

29.95

|

31.05

|

|

South Africa

|

30.13

|

32.92

|

27.88

|

26.42

|

27.38

|

30.01

|

31.29

|

35.79

|

27.40

|

27.34

|

28.82

|

|

Turkey

|

27.44

|

25.22

|

22.99

|

23.55

|

21.86

|

22.67

|

22.32

|

23.91

|

23.32

|

21.21

|

23.74

|

|

Country

|

GDP in 2050 (in billion USD)

|

|

Brazil

|

11,366

|

|

Russia

|

8,580

|

|

India

|

37,668

|

|

China

|

70,710

|

|

Total

|

128,324

|

|

Mexico

|

9,340

|

|

Indonesia

|

7,010

|

|

Korea,Rep

|

4,083

|

|

Turkey

|

3,943

|

|

Total

|

24,376

|

You might like reading:

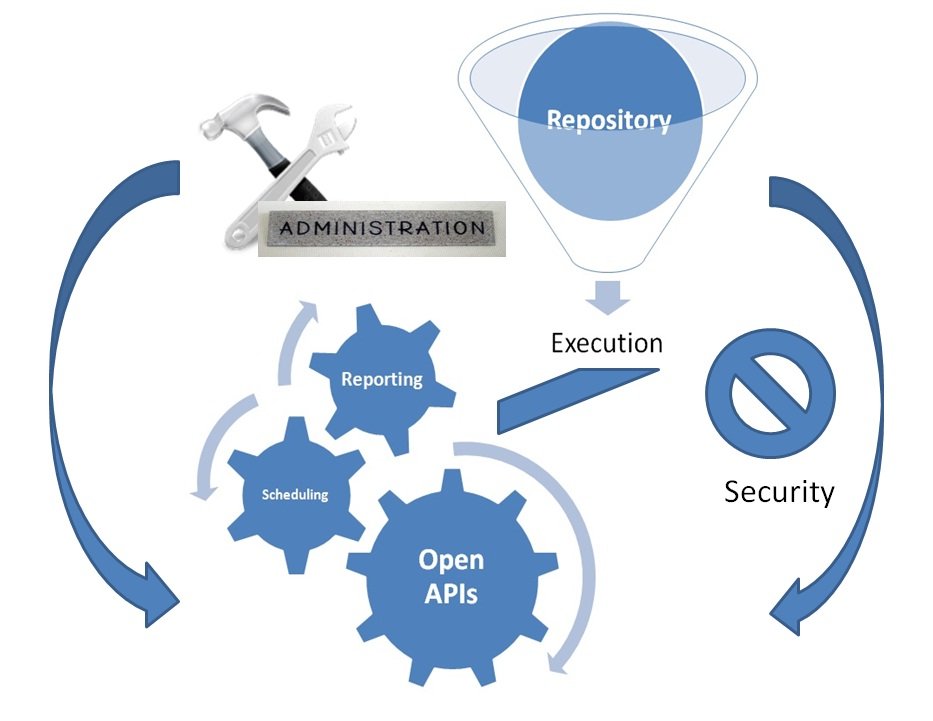

Rethinking Dashboard Governance – the future of IT organizations

The increasing realization gaps and performance gaps across IT organizations is taking attrition levels to new highs. Also these gaps are wrongly decoded and IT governance has confined itself to technological advances rather than restructuring the organizations; which has remained a myth of late. Today IT organizations require enterprise-wide change in order to effectively align them with businesses and profit […]

Entering the market

So you know you have a great product but you need to find how to position your brand in the market. Is that the dilemma you are facing at the moment as a new kid on the block? Well ideally it should not be the case as while designing it you must have decided on your target market. But it […]